Private equity (PE) is now a popular asset class with increasing investor allocation, but it gets compelling investor interest during economic downturns as well. Empirically, PE outperformed public markets in the Global Financial Crisis (GFC) and in bear markets. In fact, some of the strongest returns in PE have been generated from investments made during or coming out of downturns. But why is that? And how can investors unlock PE’s potential?

- Value creation is at the heart of private equity’s playbook, and General Partners (GPs) become more diligent about working their portfolio companies harder in times of economic uncertainty.

- Multiple expansion or buying low and selling high gains additional pertinence during economic crises and ensuing asset revaluations.

- Increasing dry powder and liquidity at GPs disposition, together with ability to wait for the right time to deploy i.e. patient capital, also contributes towards creating ideal conditions for buying.

Benefits of Private Equity Over Public Markets and Other Asset Classes

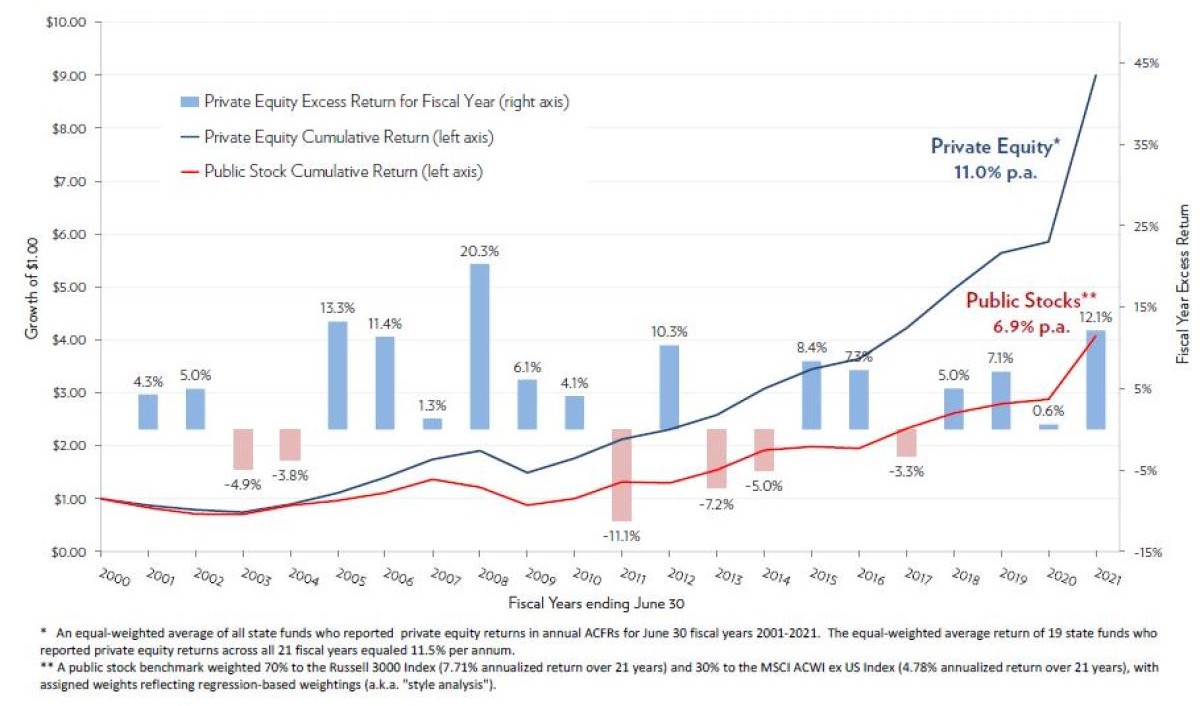

As per McKinsey, PE has remained the highest-returning asset class in private markets. Additionally, private equity has outperformed reasonable public market benchmarks over the last five-, ten-, and 20-year periods. In our view:

-

- PE is structurally more focused on value-oriented and recession-resistant sectors such as healthcare and life sciences.

- Besides sector focus, top-tier PE GPs such as GFH Financial Group (GFH) differentiate themselves through disciplined deal selection and deployment as well as institutional value creation from proprietary origination and negotiations through to curated, well-timed exits.

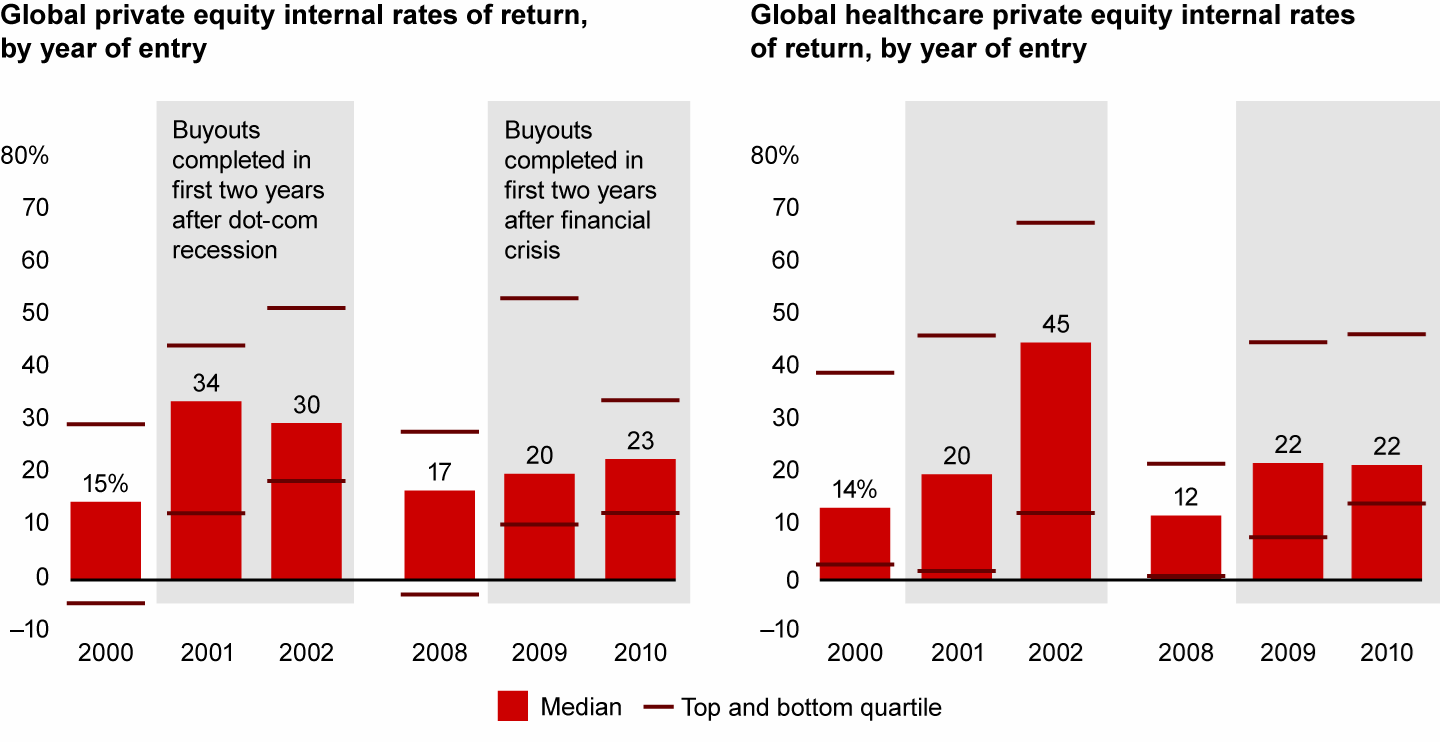

- PE is a portfolio diversifier and has proven its ability to generate returns during tough market conditions. Its outperformance against public markets over the last two decades has been pronounced during bear markets, generating some of its most attractive returns in 2001, 2002 and 2009.

- PE has historically demonstrated lower volatility compared to public markets, including lower risk of catastrophic loss. Furthermore, PE managers are less likely to panic sell during downturns due to its structural set-up and relatively sophisticated Limited Partner (LP) base.

Importantly, PE firms today are better prepared for a potential downturn than they were ahead of the GFC. This is because of:

-

- Record amount of PE capital waiting to be deployed;

- Diversification and stronger balance sheets has enhanced resilience of PE firms;

- Access to better tech and analytics to support decisions e.g., software to track the right opportunities and performance in real time; and

- Increasingly attractive market conditions for buying such as valuations reset.

Significance of Finding the Right Opportunities and Working with Top-tier Managers

There is a greater focus today on knowledge and experience in PE. Partnering with the most capable managers who bring the best talent – and investing in the rights deals in turn – is the key determinant of outperformance in our view. At GFH, we pride ourselves in our unique approach where we promote sector and thematic orientation and provide the right incentives and alignment of interests to attract talent from across the globe.

- PE is a people-first space and investors continue to favour the firms that act like engaged owners.

- Sector specialists that are experienced in navigating through economic and credit cycles are highly valuable.

- Majority of PE firms view hiring talent as one of their top priorities.

The significance of investing in the right sectors, deals, and management teams can’t be overemphasised. This ultimately owes itself to working with the right GPs and deal teams that focus intently on critical value drivers, and dynamically adapt to changing markets and macroeconomic conditions such as the impacts of inflation, rising rates, and geopolitics.

Conclusion

PE strategies offer investors long-term opportunities that have proven to outperform public markets even during downturns as well as other private markets asset classes. Importantly, investors who take a long-term view with caution and informed decision making, generally reap attractive dividends down the line.

While PE is not necessarily safer than public markets or other asset classes, the nature and structure of PE investing – across the spectrum of control buyouts to growth investing – enables GPs to deliver alpha in a de-risked manner.

Last but not the least, it’s not just the right PE firms with long track records that should matter; equally important is having best-in-class, well aligned teams with deep domain expertise and connectivity to pick and deliver on the most compelling opportunities.

As part of our upcoming topics, we will be discussing the ongoing boom in the GCC across a range of sectors, secondaries, distressed sales, and private credit as the key areas we are targeting for GFH’s investors. Stay tuned.

Sources:

1 Figure 1 – “Healthcare Private Equity in a Downturn”, Bain & Company

2 Figure 2 – “Long-Term Private Equity Performance: 2000 to 2021”, Chartered Alternative Investment Analyst Association

“From digital money transfers to AI-powered credit underwriting or investment advice, digital solutions will define how consumers interact with the banking sector over the next decades.”

Spotlight on Technology Investments

Hammad Younas

Chief Investment Officer

Private Equity

The content on our site is provided for general information only. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date.