Home / GFH Insights / The Real Estate Investment Market in the US & UK: 5 Takeaways

Our inaugural real estate investment conference in London in November tapped into our global network of partners and experts, providing unique insights into some of the key markets and asset classes in which we operate. Over two days, delegates discussed opportunities and challenges in real estate sectors in the US, UK, and Europe, including logistics, medical offices, and student housing.

Against a backdrop of macroeconomic forces and uncertainty, our conference provided a platform from which stakeholders could share knowledge and insights to better navigate the complex real estate landscape.

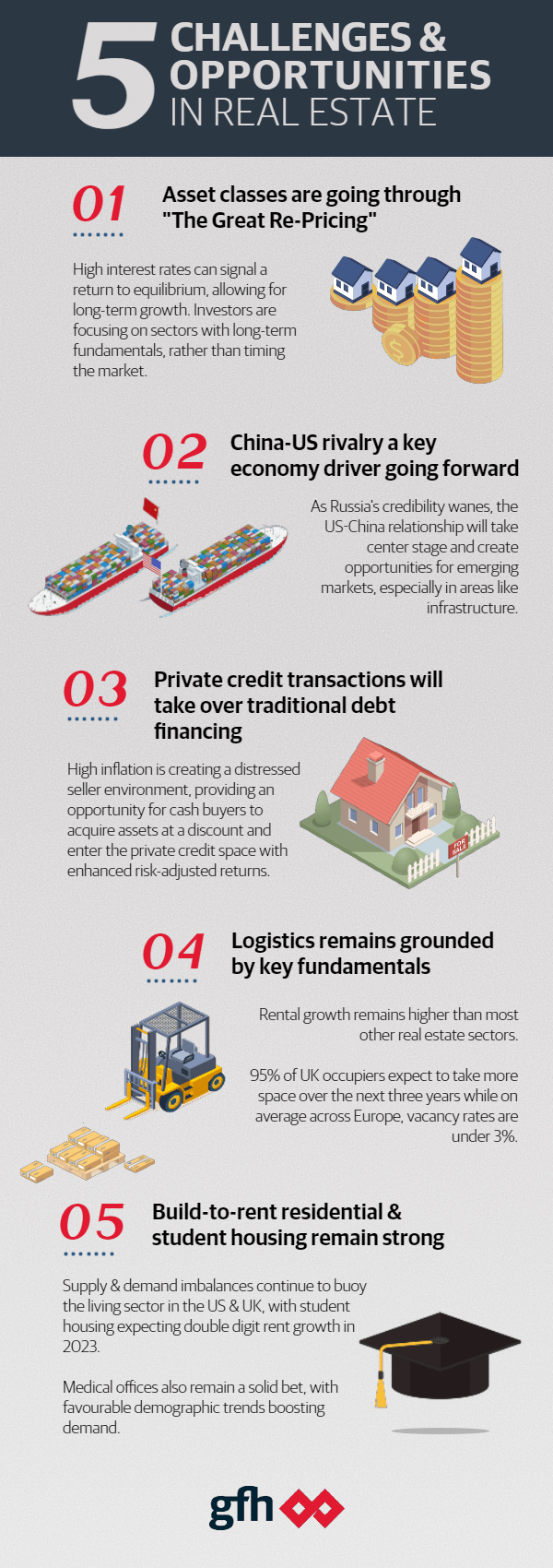

Here are the top five takeaways on the global real estate market that emerged:

1. Assets and asset classes are going through “The Great Re-pricing”

The global economy is being subjected to significant macroeconomic forces that are having real implications on where investors are choosing to deploy capital. High inflation, higher debt costs, and projected unemployment increases are some of the major forces we are witnessing that are causing the repricing of assets. The UK is one market headed for recession as a result of the current global economic landscape, placing further pressure on capital markets. According to the Bank of England, the UK’s recession is set to be longer and more severe than Europe’s.

Yet, there is reason to be optimistic in 2023 as ‘the Great Repricing’ heralds the end of the era of low interest rates. High interest rates reflect a return to an equilibrium which will allow growth in the long-term. And moving to a higher interest rate economy and accepting the consequences of that in terms of debt restructuring will allow resources to move to the more profitable companies. We are seeing that investors looking to deploy capital are not attempting to time the cycle and are focusing on sectors with long-term fundamentals such as logistics, student housing and private rented sector.

2. China-US rivalry will be a key driver of the economy going forward

Geopolitics is a growing consideration for investors than ever before as economic warfare through trade and sanctions becomes the preferred mechanism for exerting power. The war in Ukraine continues to be a significant factor but the West is quickly learning to adjust to a new reality. The ongoing economic rivalry between China and the US will continue to impact the global economy; however, it is unlikely both countries would pursue a strategy of containment and some cooperation will continue to drive globalisation. The US-China relationship will take centre stage, especially as Russia’s international influence and credibility wanes following its invasion of Ukraine. This will create more opportunities for emerging markets, especially in areas such as infrastructure, as China continues with its Belt and Road initiative and the US seeks to counter.

3. Traditional debt financing will be limited giving rise to private credit transactions

Interest rate rises meant to combat high inflation have led to a significant increase in borrowing costs. As a result, we can expect valuations to continue to trend lower as yields soften well into 2023. Traditional lenders are increasingly selective with their criteria and offering terms with lower loan-to-value (LTV) and higher margins. Although yields have softened, borrowing costs are still higher than yields, resulting in negative leverage. Therefore, buyers requiring leverage are on the side lines waiting until yields adjust or borrowing costs reduce.

The current landscape is creating forced sellers who require liquidity or are unable to arrange refinancing. In turn, this creates an opportunity for cash buyers to acquire assets at an historic discount. We can expect to see more distressed sellers and distressed assets in 2023. The key for investors will be to focus on distressed sellers with quality assets. This unique set of circumstances creates an opportunity to enter the private credit space with enhanced risk adjusted returns compared to equity investing.

4. Logistics continues to be supported by key fundamentals

Logistics has seen the biggest yield shift, but the sector continues to be supported by strong fundamentals and favourable long-term trends. For instance, real rental growth is higher than most other real estate sectors, with continuing, albeit slower e-commerce growth driving the sector, along with onshoring and nearshoring. In fact, by 2025, the average level of online retail will be 25%. This will require an additional 26.3 million square metres of warehousing in the UK alone. In the UK, 95% of occupiers expect to take more space over the next three years while on average across Europe, vacancy rates are under 3%.

The fact that some logistics giants, namely Amazon and FedEx, are scaling back operations does not reflect a downturn in the logistics sector. The space they are giving back to the market is a small proportion of the total leasing amount and there is continued demand from other players in the market.

5. Build-to-rent residential and student housing is “en vogue”

There are strong opportunities in the US and UK markets within the living sector including build-to-rent (BTR) and purpose-built student accommodation (PBSA), which both benefit from supply and demand imbalances. While certain sectors have witnessed some yield softening, the long-term fundamentals remain strong. Medical offices and the living sector have the best supply and demand dynamics and favourable long-term trends. US medical offices occupancy rates are at almost 100% due to short supply and increasing healthcare demand. The office and retail sectors are still undergoing a structural shift.

Meanwhile, student housing is expecting double digit rent growth in 2023 as institutions struggle to keep up with demand, spending money instead on new classrooms and facilities. Investors should continue to keep in mind the adage ‘cash is king’ and must be prepared to buy all cash and without any leverage to take advantage of opportunities. Finally, debt investments are offering better risk adjusted returns with a window of 12-18 months until repricing is more predictable and debt costs stabilise.

Final Thoughts

The overriding sentiment that came out of our London conference was one of cautious optimism despite economic downturns in several major markets. Our message to investors is that while inflation and other forces are impacting certain real estate segments, 2023 is an excellent chance to capitalise on opportunities in sub-sectors underpinned by robust fundamentals. Logistics, purpose-built student housing, and medical clinics are promising, recession-proof, defensive segments that are overperforming other sectors.

The content on our site is provided for general information only. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date.