Home / GFH Insights / The Long-term Fundamentals of US Student Housing Continue to Exhibit Resilience

GFH Partners has formulized a strategy that is aligned to deliver consistent returns in defensive sectors that have strong long-term fundamentals. In particular, student housing, which serves the education sector, has proven its resiliency to macroeconomic headwinds, and as the sector has not fully matured from a supply perspective, GFH Partners has pursued building a platform that caters the continuous demand over the sector. These efforts have been expanded upon by means of acquiring experienced operating managers with a robust track record, and ultimately, on the path to be fully vertically integrated within the sector.

The student housing sector in the US is highly dynamic, drawing significant attention due to its substantial growth and ever-evolving trends. With millions of students enrolled in colleges and universities nationwide, the demand for suitable housing options remains robust.

The Evolution of the Student Housing Sector

Key Trends in US Student Housing

Over the past decade, there has been a notable increase in private investment in purpose-built student housing, driven by rising enrollment and the desire for modern amenities among students. Several trends recently indicate investor preferences shifting from other living forms to student housing in particular due to its potential to generate above-average returns and consistent cash flows. Despite a significant increase in effective rent growth of around 8% in top-tier universities between August 2022 and August 2023—more than three times the national market-rate rent growth—rental rates remain variable primarily due to the persistent imbalances between supply and demand. Demand continues to outstrip supply, with average occupancy rates reaching 95%. The scarcity of supply in recent years can be attributed mainly to escalating construction costs and rising interest rates.

1) Driving Enrollment Rates

Considering both public and private schools, the total enrollment for academic year 2024-2025 is projected to surpass 15 million students, excluding international students, who alone accounted for 1 million students in 2023. The US student housing market is undoubtedly facing significant supply and demand imbalances for quality accommodation.

2) Limited Transactions

With robust fundamentals in place, numerous owners are opting to maximize leasing activity and revenue growth by retaining ownership of their assets instead of selling them. This decision has led to a decrease in the number of property deliveries entering the market, further contributing to a muted supply of available properties.

3) Supply and Demand Imbalances

In the United States, a significant change in student housing preferences has emerged, with the majority (63%) now favouring off-campus living over on-campus accommodations. This shift is primarily a response to the limited availability of on-campus housing options. However, it also reflects a growing preference among students for community-style living arrangements that offer comprehensive amenities and experiences. Demand is particularly high for communities equipped with Wi-Fi, fitness centers, communal spaces, study lounges, and cafes.

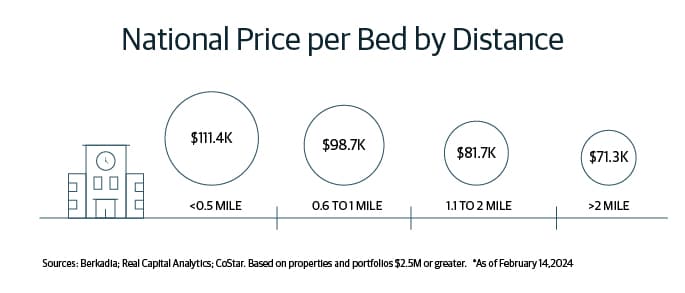

In line with these evolving preferences, student housing developments are increasingly commanding substantial premiums, especially those situated in prime locations near university campuses. Additionally, there’s a notable focus on catering to high enrollment, Tier 1 universities strategically located for growth, accessibility, and safety considerations.

This significant uptick in enrollment has accentuated the gap between supply and demand, particularly notable in universities undergoing rapid enrollment expansion. Moreover, preleasing initiatives are kicking off earlier each year, as operators seize upon the increased demand stemming from enrollment growth and the limited supply observed in recent times.

Rent growth trends typically mirror occupancy and preleasing rates, with markets exhibiting robust fall 2023 occupancy and rapid preleasing, experiencing the most pronounced rent growth. It’s notable that several major markets witnessing double-digit rent growth have also been at the forefront of preleasing for the 2024-2025 academic year, indicating a strong correlation between preleasing speed and rent escalation.

4) Muted Supply

As of February 2024, the student housing market size has surpassed a valuation of $10 billion and is poised for further expansion in the next 5 years. According to the National Multi-Family Housing Council (“NMHC”), the sector is expected to witness substantial growth, with the number of student housing beds projected to increase from 8.5 million beds in 2020 to 9.2 million by 2031. This translates to an average annual growth of 734,000 beds, representing a steady annual increase of 0.8% per annum, with the demand from public four-year universities driving a significant portion of this growth.

Despite more than 20 million students enrolling in universities and colleges, studies reveal that the existing supply can only accommodate 22% of undergraduates. This severe disparity between demand and supply has led to heightened rental rates and occupancy levels in recent years. Charging premiums also contributes to the upward trend in rent rates, particularly for fully amenitized assets located closer to campus.

“Despite more than 20 million students enrolling in universities and colleges, studies reveal that the existing supply can only accommodate 22% of undergraduates.”

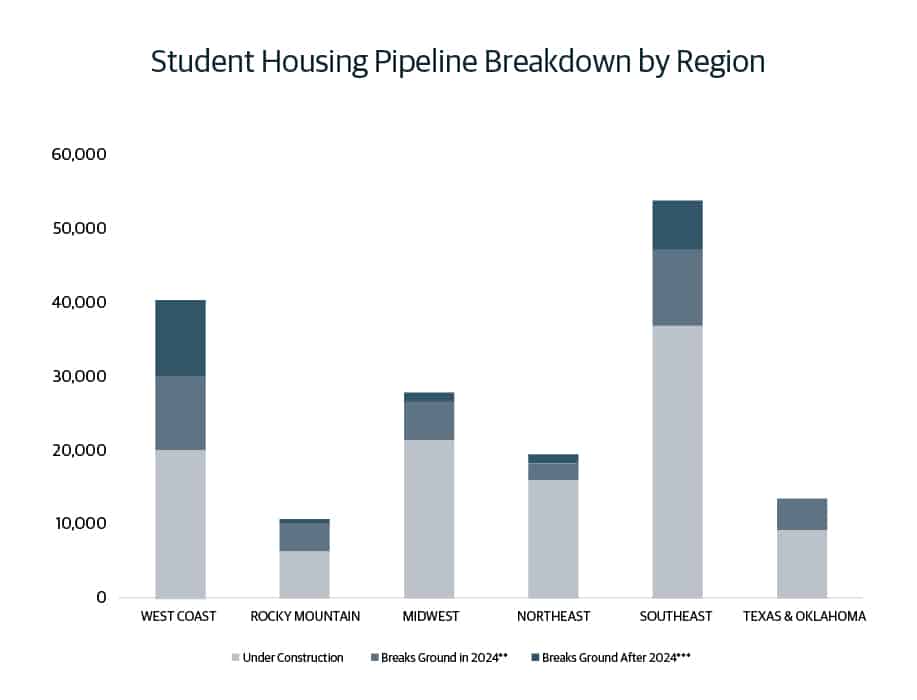

While developers are currently working on around 109,500 beds scheduled for delivery for the 2024-2025 academic year, projections indicate a steep decline in new supply. Only 55,332 beds are expected to commence construction in 2024. The average construction timeline for such properties spans approximately 25 months, and costs have surged by 40-50%, driven by escalating fees, expensive labor and contracts, and the rising cost of building materials.

Given the shortage of available land, investors are exploring alternative avenues such as repurposing existing projects and transforming older accommodations into renewed opportunities to address the growing demand for student housing.

The landscape of the US student housing sector is constantly adapting to accommodate shifting demographics and evolving student preferences. By remaining agile and responsive to market dynamics, the sector is well-positioned to capitalize on this ongoing evolution and sustain its growth trajectory.

Spotlight on Student Housing Investments

SQ Asset Management is a US-based specialist living sector asset manager and property manager focused on student housing, with a demonstrated track record of value generation and execution. SQ currently has US$ c. 1.3 billion in AUM, comprised of 34 student housing properties with more than 12,500 beds under management, located across 22 campuses. SQ is a subsidiary of GFH Partners Ltd. To learn more about SQ Asset Management, visit our website.

None of the commentary above is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product, or instrument. Each of the statements, disclosures and disclaimers contained herein, including that these materials herein (A) are for informational purposes only, (B) are not an offer or solicitation to buy or sell any securities, and (C) should not be relied upon to make any investment decisions.

The content on our site is provided for general information only. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date.