Home / GFH Insights / 2024 US Medical Real Estate Outlook

As we near the second half of 2024, investor optimism for commercial real estate is beginning to improve. 10-year Treasuries peaked at nearly 5% in October before falling below 4% at the end of the year. For sellers, 2023 proved to be a tough year for valuations as prices dipped and loans started to mature. In general, 2023 was a much slower transaction year for most firms.

Our firm is looking forward to 2024 and believes the market is ripe for great buys with large profits. When considering opportunities that lie ahead, we believe that healthcare real estate remains one of the best performing assets during this turbulent time.

Healthcare Demand Driver – The Elderly

Unlike other real estate asset classes, healthcare real estate’s underlying demand is driven by demographics rather than the broader economy. Put differently, data suggests there is minimal correlation between the economy and healthcare spending which results in healthcare real estate consistently outperforming other asset types. Since a disproportionate amount of healthcare spending occurs near the end of one’s life (over the age of 65), the need for more healthcare related services increases as the population ages. In the US, the Baby Boomers born between 1946 and 1964 are currently 59-77 years old. The population of the Baby Boomer generation is nearly twice the size of the prior generation, creating significant growth for the healthcare system in the US. This growth will occur regardless of the US economy’s performance.

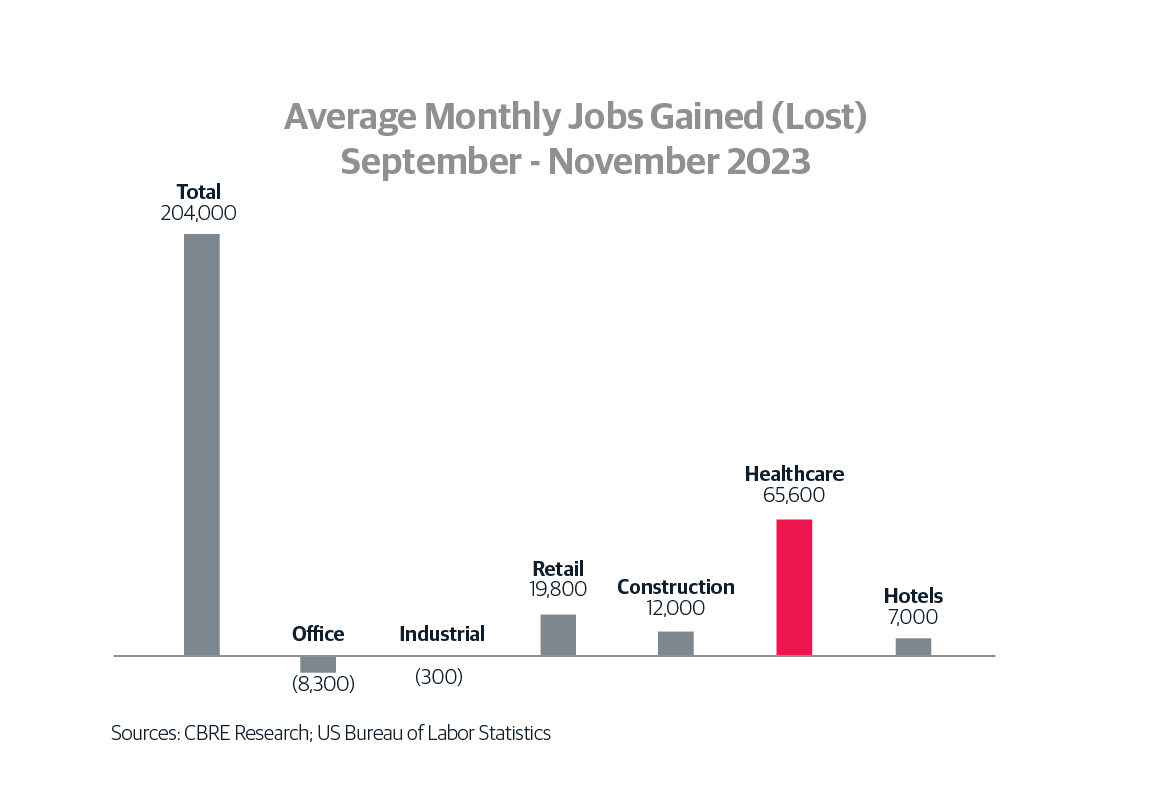

Substantial Job Growth

Most recently, we have seen the impact of the healthcare industry’s growth in the US jobs reports. In December 2023, the US Bureau of Labor Statistics published average job gains of 204,000 for the three months of September through November 2023. Of the average jobs gained, 65,600 were from healthcare or said differently healthcare created 32% of the new jobs in the US! Despite being a substantially smaller asset group, healthcare’s job creation is almost six times larger than the collective jobs gained by the office, retail and industrial sectors combined.

Increasing Occupancy

Consumers spending money on healthcare creates jobs, and employees need space to work.

As a result, the need for medical space has never been greater. According to JLL, medical clinic properties hit their highest occupancy ever recorded at 93.0% for the quarter ending September 30, 2023. They usually hovered within a relatively narrow range of 91.0 to 92.5%, dipping to 90.5% in the depths of the financial crisis in Q1 2009. With the high price of debt, new projects have been slower to come out of the ground. As such, Big Sky expects supply to be stable and the occupancies to hold steady or increase over 2024.

Divergent Debt Spreads

As the capital markets have tightened, access to capital has been reduced. Healthcare real estate lenders are still lending, but are more selective in their loans. When measuring the relative price of debt over time, we look at the spreads over the indices for real estate loans from our lenders. Spreads on loans for core assets have widened only slightly since 2018 while the spreads on value-add assets have increased significantly. This spread differential has disproportionately increased the cap rates for value-add and opportunistic medical assets when compared to core or income- producing properties. Big Sky feels the best opportunities in 2024 will come in the value-add part of the medical real estate sector due to this divergence in spreads.

Strategies in 2024

Prior to 2023, Big Sky primarily invested in fully occupied, income-producing core medical assets. This year, we intend to target the value-add sector to capitalize on the market displacement occurring within that part of the sector. Although the medical assets have performed well during this downcycle, they are still subject to global capital constraints which hurt the valuations of the higher-risk medical assets more than the core assets. We intend to focus on these assets by investing in both parts of the capital stack: debt and equity.

We plan to launch an opportunistic fund with a three-pronged approach to investing equity into value-add medical assets: 1) reposition underutilized real estate like a call center into medical clinics, 2) provide development capital to hospitals and physician groups for new projects, and 3) buy value-add assets from investors as they near the end of their loan terms. Over the past few months, Big Sky has executed five conversions under this strategy including the rezoning of a 145k square foot class-A office building for medical use.

In addition to equity investments, we intend to launch a debt initiative to provide leverage for investors not looking to sell but facing loans maturities. Recently for investors seeking income, debt has provided the best overall return for its relatively lower risk. As borrowers refinance their loans, the debt options have decreased, which are driving leverage down and spreads up. For example in 2024, there is over $2 billion of healthcare CMBS maturities per the Mortgage Bankers Association survey results. Big Sky intends to use its relationships and underwriting expertise to capitalize on this part of the capital stack over the next couple of years.

Final Thoughts

Healthcare real estate historically has performed best (on a relative basis) when other assets underperform. Like utilities, healthcare’s demand drivers are not linked to the economy. Even though the economy fluctuates annually, people consistently place a high value on their health and wellness. As such, healthcare should be a substantial driver for growth in the US over the next decade as favorable demographics and a push towards outpatient medical care drive the need for more clinic space. As the capital markets continue to improve, Big Sky believes there will be one of the best investment opportunities in recent history over the next couple of years. We are excited about what is to come!

If you have interest in learning more about Big Sky and our product offerings, please contact Mark Sullivan at msullivan@bigskymed.com.

“From digital money transfers to AI-powered credit underwriting or investment advice, digital solutions will define how consumers interact with the banking sector over the next decades.”

Spotlight on Healthcare Real Estate Investments

Big Sky Medical Asset Management is an investment manager focused on commercial real estate across the United States with an overweight focus on the healthcare real estate sector. Big Sky has over USD 1.1bn in total assets under management, with 43 total assets across 17 states. Big Sky is a subsidiary of GFH Partners Ltd. To learn more about GFH Partners Ltd., visit our website.

None of the commentary above is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product, or instrument. Each of the statements, disclosures and disclaimers contained herein, including that these materials herein (A) are for informational purposes only, (B) are not an offer or solicitation to buy or sell any securities, and (C) should not be relied upon to make any investment decisions.

The content on our site is provided for general information only. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date.