Home / GFH Insights / The Benefits of Investing in US Medical Clinic Real Estate

With all of the current uncertainty, most investors live through a rollercoaster of angst as various headlines emerge with the latest turmoil. From the risks of inflation, Covid-related disruptions, and the ever-impending recessionary fears, many factors affect our investment outcomes. Fundamentally, medical real estate is a consistent performer throughout every period of disruption and avoids most of the losses which can decimate other investments.

We believe in adopting the SWAN (Sleep Well at Night) approach to investing. Similar to dollar cost averaging, SWAN investing focuses on being disciplined by buying lower volatility investments consistently as opposed to trying to time the market and swing for the fences on high returns. By removing the valleys which occur during downcycles, we believe investing with a steady return over time provides better long-term results. Fortunately, US medical real estate provides the consistent fundamentals which produces reliable returns while mitigating the deep dips over time.

Among the various sectors within commercial real estate, medical investments have gained significant momentum in recent years due to this trend. Medical clinics and life science facilities remain one of the strongest commercial real estate sectors due to the strength of the underlying tenants.

Resilience in the Healthcare Industry

The healthcare industry has proven to be resilient and continues to experience steady growth even during economic downturns. The demand for medical services remains robust driven by an aging population and increased healthcare spending. Since the 1960s, healthcare spending has risen every year in the United States and is one of the largest industries in the US composing 18% of the US GDP. In addition, healthcare is the second largest entitlement program in the US (behind Social Security) with strong political tailwinds. Given that people consume more healthcare services as they age, healthcare spending is forecasted for continued growth as the Baby Boomer population enters retirement.

Growing Medical Real Estate Demand

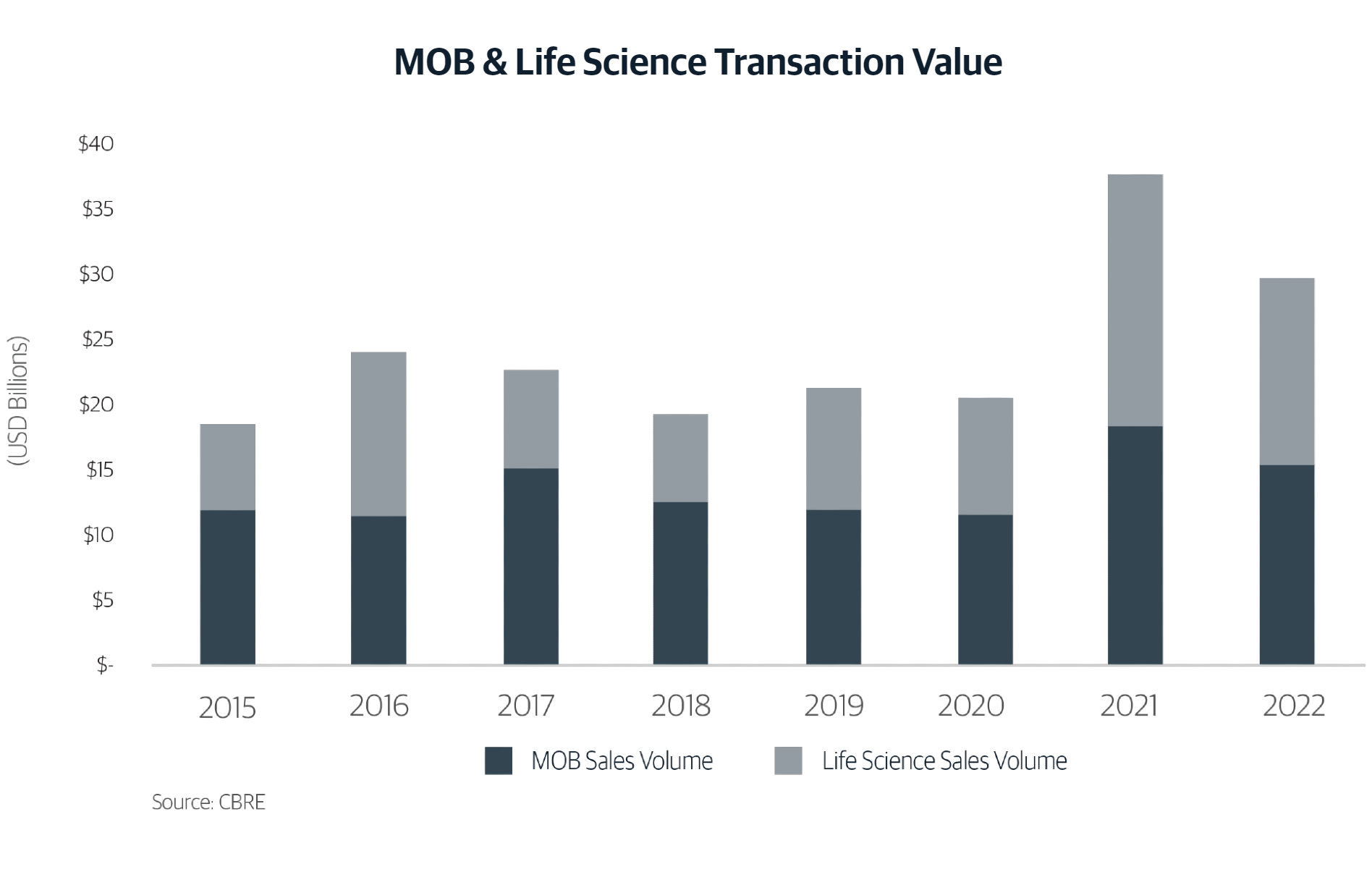

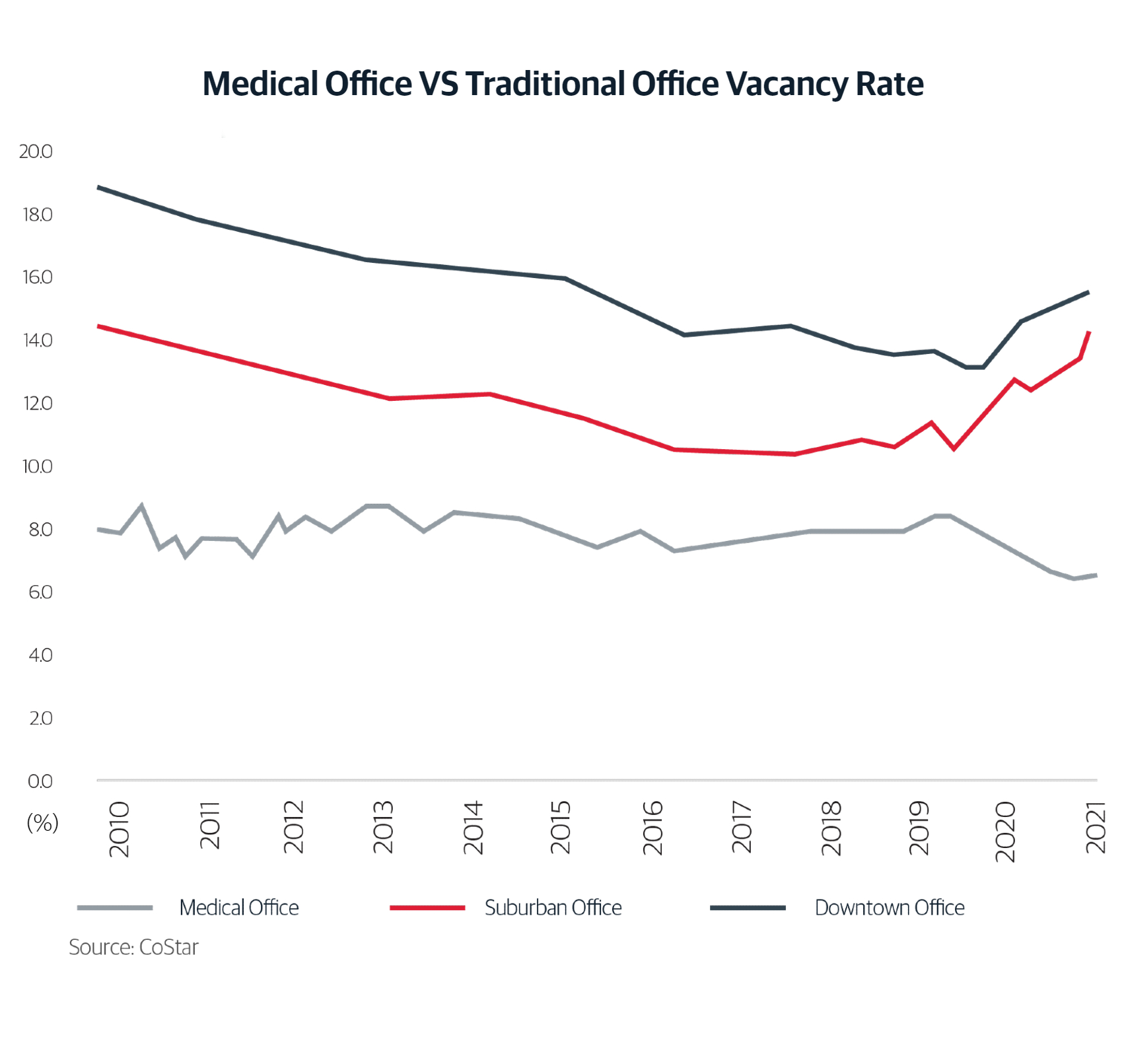

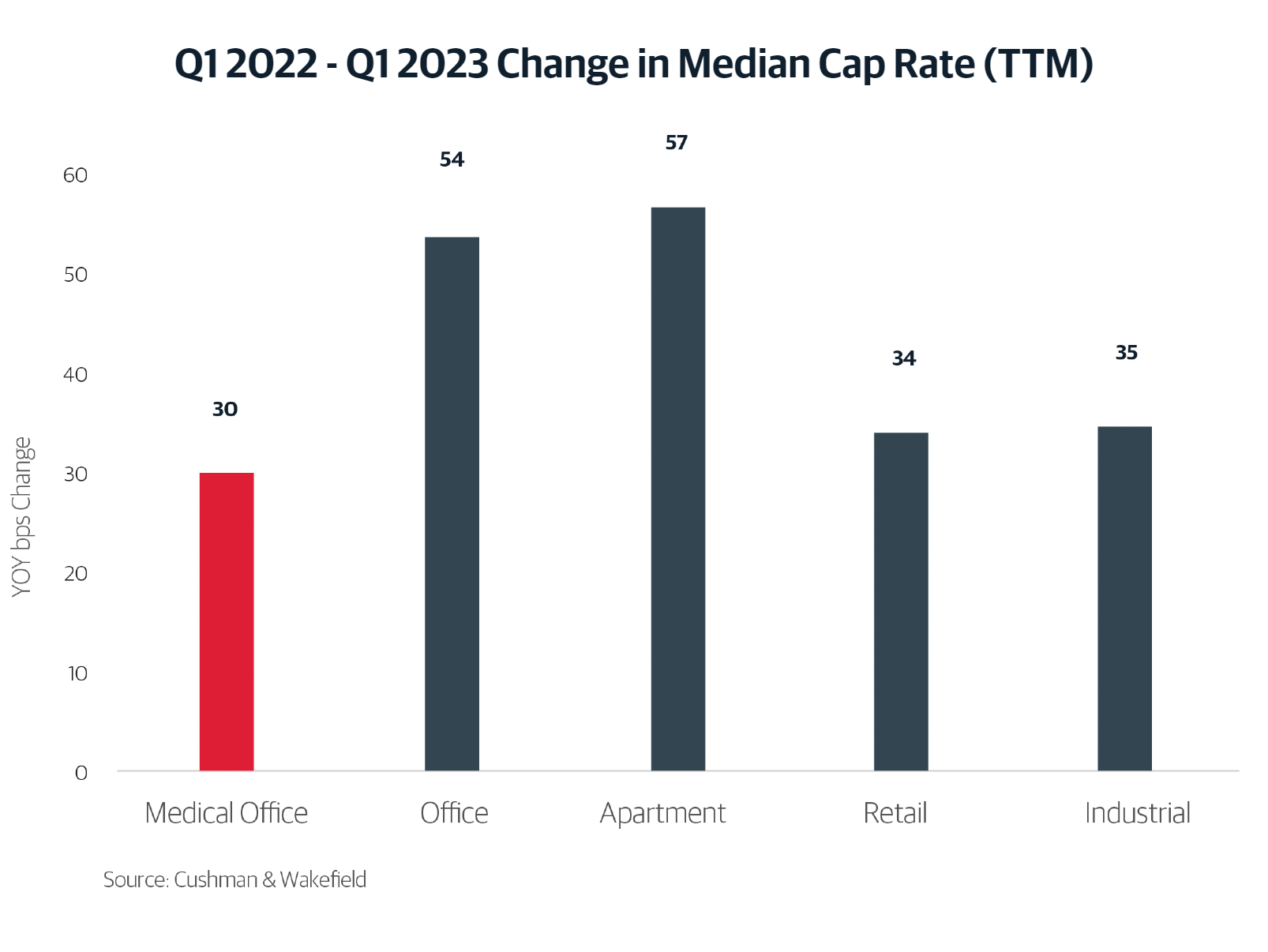

The growing demand for medical services translates into an increased need for high-quality medical clinics. Investors have taken note: medical real estate transaction volume has increased significantly within recent years. 2021 and 2022 had an average of $34 billion in annual sales volume. Medical clinics and life science facilities now account for nearly 5% of all commercial real estate sales transactions in the US. Because of this growing demand for medical real estate and its corresponding low volatility, cap rates have risen slower than other traditional real estate asset types despite rising interest rates.

Unparalleled Opportunity

To capture the best assets, Big Sky Medical leverages its existing relationships within the medical real estate industry to capitalize on off market deals by utilizing their extensive network. By cultivating strong relationships with healthcare providers, developers, brokers, and property owners, Big Sky Medical can gain access to exclusive off-market opportunities before they become widely available. These relationships enable Big Sky to stay informed about potential off-market deals, negotiate favorable terms, and seize unique investment opportunities that may not be accessible through traditional channels.

Sustained Cash Flow

Investing in U.S. medical real estate is highly liquid and bolstered by a plethora of indicators that point to sustained growth in the coming years. Debt spreads are one way that banks measure risk on the underlying investments. For medical real estate, spreads have remained relatively stable in the (200-240 bps range) while spreads on other commercial real estate loans have widened by 50-100 bps since 2022. Given lenders are very good at quantifying risk, we believe that medical real estate provides the best risk adjusted return today. At Big Sky, we are still able to source quality medical real estate acquisitions which produce a leveraged cash on cash return of 7-9% annually by utilizing relatively low-cost lending and modest leverage (60-65% LTV).

Final Thoughts

The future for medical real estate is bright. With the resilience of its underlying demand drivers and the increased appetite from institutional investors, we believe medical real estate has some of the best risk-adjusted returns in commercial real estate. When the markets are trying to decide between doves and hawks, adopt a SWAN approach and invest in medical real estate with Big Sky.

“From digital money transfers to AI-powered credit underwriting or investment advice, digital solutions will define how consumers interact with the banking sector over the next decades.”

Spotlight on Healthcare Real Estate Investments

Big Sky Medical Real Estate is a real estate investment firm that invests in healthcare real estate investments across the United States with an overweight concentration within the medical office sector. In the past 15 years, its Principals have invested in nearly 6 million square feet of healthcare property across 19 states valued at over $2 Billion. Big Sky Medical is an affiliate of GFH Partners. To learn more about GFH Partners, visit our website.

None of the commentary above is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product, or instrument. Each of the statements, disclosures and disclaimers contained herein, including that these materials herein (A) are for informational purposes only, (B) are not an offer or solicitation to buy or sell any securities, and (C) should not be relied upon to make any investment decisions.

The content on our site is provided for general information only. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date.