Home / GFH Insights / Opportunities in U.S. Student Housing

The Student Housing asset class has continued to mature over the past decade, particularly in the United States, attracting institutional capital from across the globe as part of a diversified real asset investment portfolio. This is evidenced by the resiliency shown in how Purpose-Built Student Housing (“PBSH”) responded to the widespread economic challenges that began in Spring 2020.

Tailwinds from a Supply and Demand Imbalance

With headwinds from the capital markets and broader economic uncertainty, why is Student Housing performing at all-time levels post-Covid?

- Higher Enrollment Figures: Enrollment in the U.S. higher education system rebounded immediately from a Covid lull with many Tier 1 markets enrolling record freshman classes. Students who removed themselves or postponed school are now back. Additionally, the U.S. saw the return of international students who are able to travel abroad again without Covid-related travel restrictions, the population of which traditionally accounted for approximately 5% of enrollment.

- Limited New Deliveries: New developments in the pipeline for growing markets typically can meet the consistent demand for off-campus PBSH. However, Covid wreaked havoc on the construction pipeline due to labor shortages, supply chain issues, and the impact of rising interest rates. About 30,000 beds were delivered in Fall 2022 – the lowest since 2010. As a result, there is a distinct shortage of beds available to house students, which is a phenomenon that may persist for the next 2-3 years as moderate amounts of new product comes to market.

Record Performance

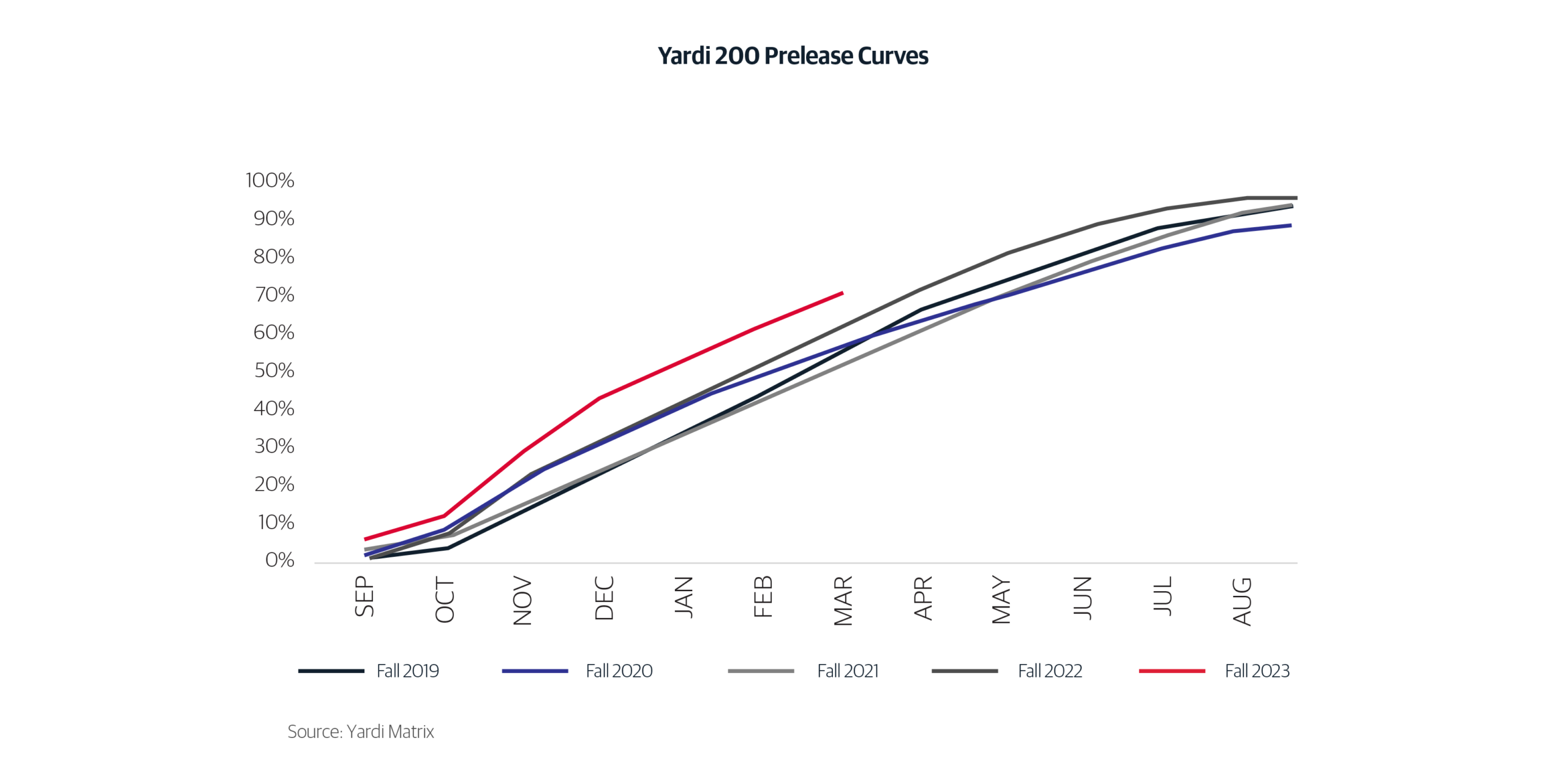

Important to the story are the secondary effects of the Covid pandemic that created a significant supply and demand imbalance for student housing. The positive impact of this dynamic became apparent 1Q22 as preleasing velocity was 10.7% higher than pre-pandemic levels, resulting in record occupancy and rent growth, 96% and 7% respectively for the 2022/23 academic year. All signs indicate there is plenty of runway for outsized demand over the next 2-3 years as preleasing velocity increased 12.6% for this upcoming academic year.

Capital Markets

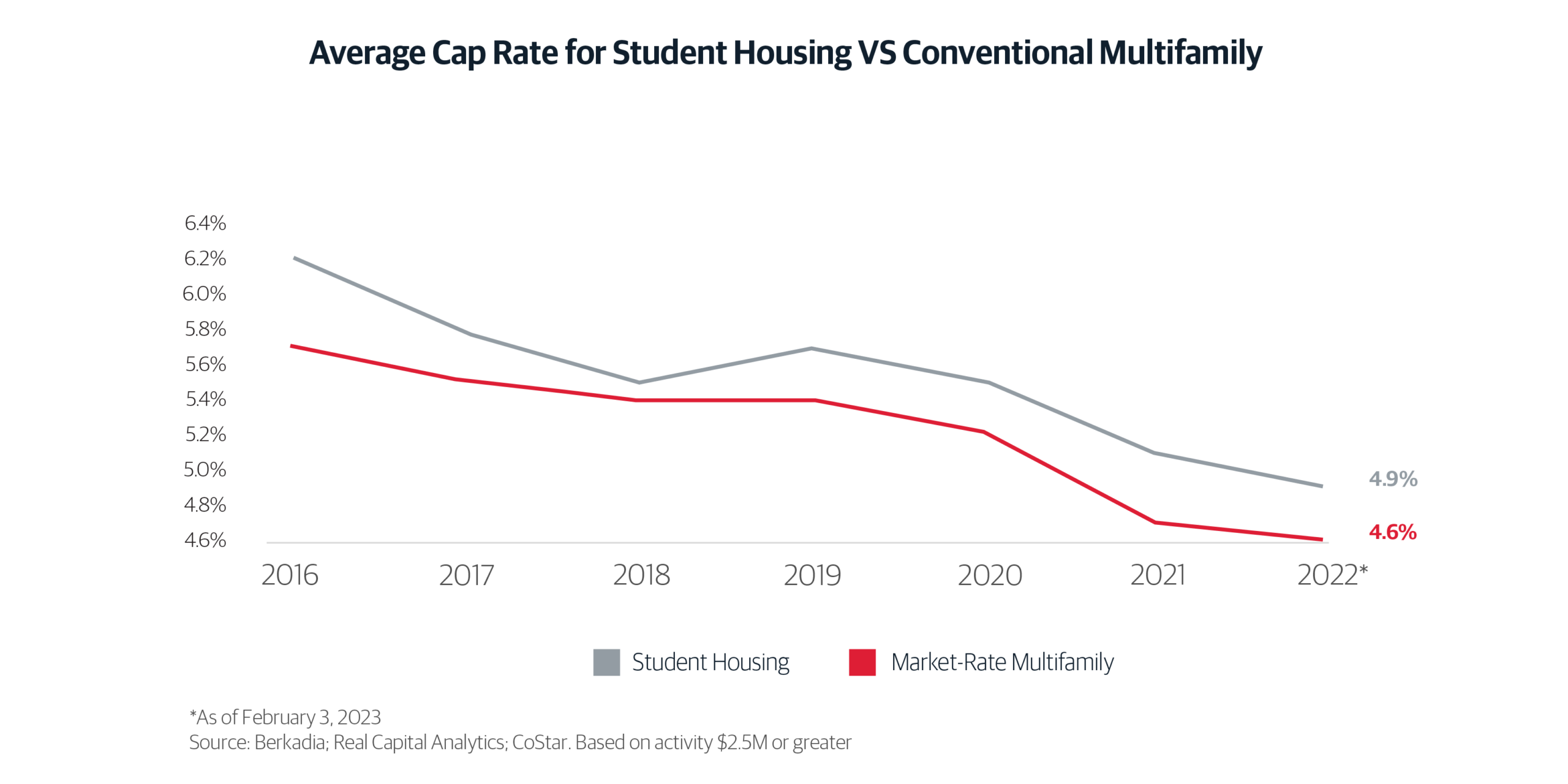

Cap rates for Student Housing, still offering a premium to conventional multifamily, converged between 4.5-5.0% as Student Housing is increasingly targeted by a larger pool of investors. Financing costs have weighed on property value and from an underwriting perspective, we see entry year 1 cap rates generally 100 bps wider, exposing very attractive buying opportunities in certain markets. This is important as we aim to be leverage positive in the first year of operations for new acquisitions.

The debt market is widely available and we work with all lender types for fixed- and floating-rate options with terms that meet the asset’s business plan and hold period. The strong fundamentals along with the preleasing activity, which effectively begins move-in day for the following year, offers a great degree of transparency into property performance and our ability as Sponsors to deliver results. Leverage came under pressure as deals became debt service constrained in the higher rate environment, so what was 60-65% a year ago is now between 55-60%.

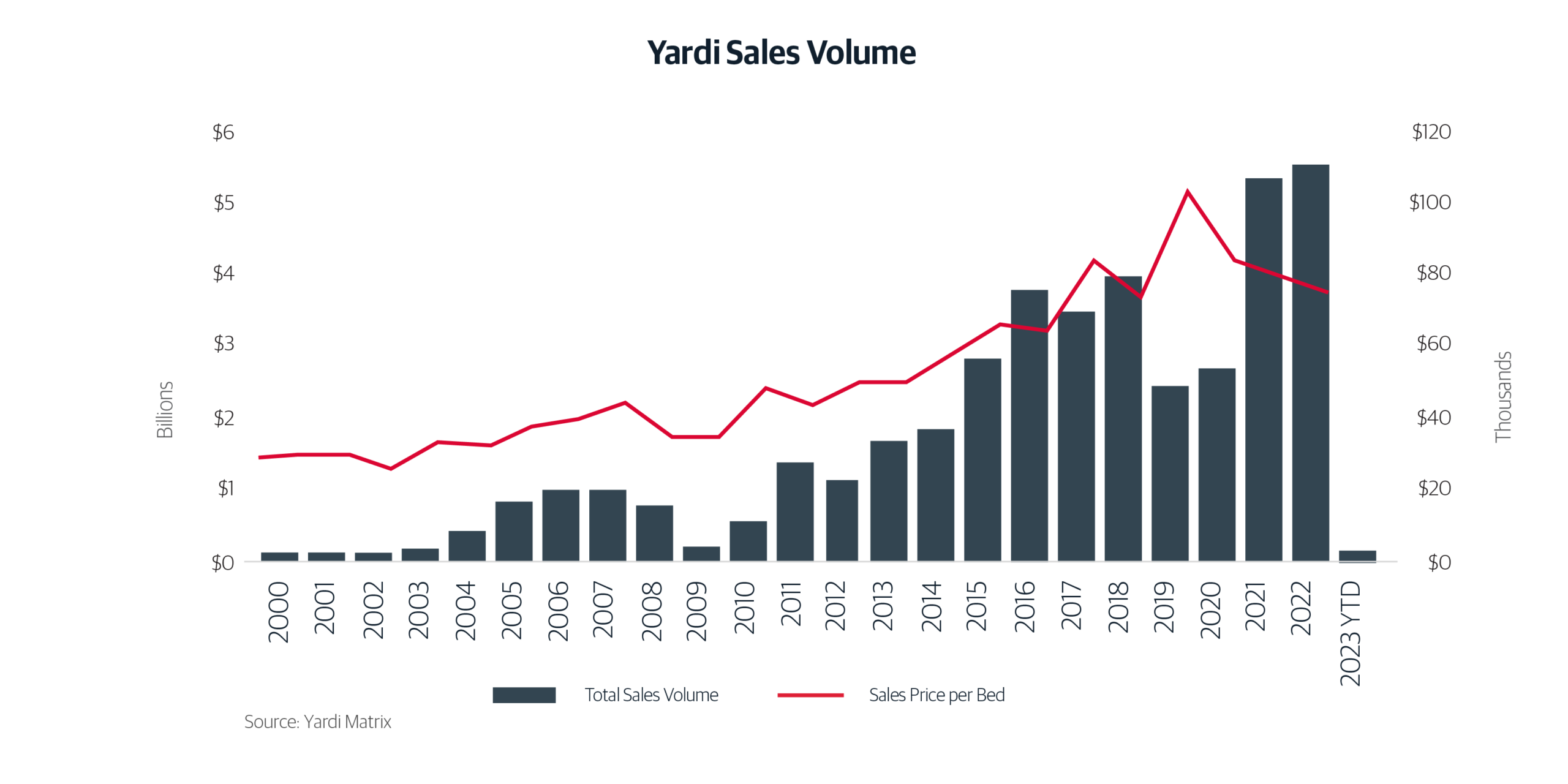

- Anticipated Transaction Volume: Thankfully, Covid seems like a distant memory as investors now navigate today’s economic headlines dominated by inflation, interest rate volatility, and banking challenges. The impacts of which have done little to deter activity in the U.S. economy as the annualized GDP growth rate has been +3.2%, +2.6%, and +1.3% over the past three consecutive quarters. The uncertainty, however, did contribute to a sharp decline of commercial real estate transaction volume across all asset classes in the first half of 2023, creating another supply and demand imbalance – this time for investors.

- Despite this reality, the Acquisition Team at Student Quarters led by long-time industry expert, Andrew Layton, has been actively engaged with brokers and owners directly to curate a robust pipeline of on- and off-market deals that meet our investment criteria. We expect to see a considerable increase in the number of deals in the market for the second half of the year as the new leasing cycle takes effect in September and lenders can assign value for the historic rent growth that is on pace to surpass 10% on average and up to 20% in select markets.

Student Quarters

As a vertically integrated, owner and operator of more than 30 assets and 11,000 beds across the U.S., we are bullish on the industry’s outlook. Important to our success is the alignment of Acquisition, Asset Management and Property Management that allows SQ to be immediately responsive to the needs at each asset to maximize NOI growth (through both top line revenue and expense management) and ultimately IRR. Our realized track record supports this, and we have delivered a 21.4% net IRR to our investors across 13 dispositions.

Acquisitions Pipeline

By deploying a “whole firm” strategy to acquisitions/underwriting and operations, we are able to identify unique buying opportunities outside of a traditional marketed process as part of a robust deal pipeline. Interestingly, roughly 40% of our portfolio was sourced off-market through industry relationships.

Our pipeline can be viewed in two groups 1) Stabilized assets that we are underwriting and pursuing, and 2) Development opportunities with a build, stabilize, then exit strategy. With a data driven asset selection process, we narrowed down the approximately 3,900 postsecondary institutions to about 125 target markets that consistently outperform. Key areas of focus include:

- Top University Markets: Tier-1 public 4-year universities with enrollment in excess of 20,000 students, NCAA Division 1 sports teams, and R1/R2 research funding designations.

- Asset Profile: High-quality, purpose-built, student housing assets delivered post-2016 with 250+ beds and within a 1-mile radius of campus / center of campus activity.

- Operational Upside: Opportunities to reposition underperforming assets with below market rents / occupancies through leasing, marketing, and strategic capital upgrades.

- Value-Add Initiatives: Ability to generate attractive risk-adjusted yield on capital initiatives through light / heavy value-add programs for select opportunities.

In Summary

As we enter the second half of 2023, Student Housing has great long-term fundamentals and a unique supply and demand story in the short term that we expect to develop over the next 2-3 years. This should result in above average rental growth and occupancy. In addition, we can now buy assets at pricing levels we have not seen in several years given the rise in cap rates and corresponding value resets. With a focus on selecting strong markets and deploying best-in-class operators, investors will be well-poised to outperform.

“From digital money transfers to AI-powered credit underwriting or investment advice, digital solutions will define how consumers interact with the banking sector over the next decades.”

Spotlight on Healthcare Real Estate Investments

Since its founding in 2013, Student Quarters has built a meaningful portfolio in its target markets. Student Quarters currently has US$1 billion in AUM, comprised of 34 student housing properties with more than 11,000 beds under management. Student Quarters has been ranked as one of the top 25 owners of student housing in the United States and continues to be one of the most active and vertically-integrated operators in the industry. Student Quarters is an affiliate of GFH Partners. To learn more about GFH Partners, visit their website.

None of the commentary above is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product, or instrument. Each of the statements, disclosures and disclaimers contained herein, including that these materials herein (A) are for informational purposes only, (B) are not an offer or solicitation to buy or sell any securities, and (C) should not be relied upon to make any investment decisions.

The content on our site is provided for general information only. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date.