Home / GFH Insights / Investing in UK Logistics: Not all investors have a HALO?

Economy and capital markets

We live in a world where global news events, covering all aspects of daily life, are constantly being updated and broadcasted via social media and online publications, accessed easily by one click on our mobile phone devices. Whilst being kept up to date is helpful in the broader context of having a greater understanding of the global macro position, when the continuous information flow of the economic environment is negative, it can easily skew your investment rationale in that direction and potentially lead you to miss a profitable opportunity.

In recent weeks, multiple news publications sensationalised JP Morgan’s CEO Jamie Dimon’s forecasting of further turmoil across US banks, with headlines such as commercial real estate is the most vulnerable. Headlines like this can influence investment decisions, but when delving further Dimon’s warning is focussed around commercial real estate loans and specifically the exposure banks have to the US office market.

Six months ago the headlines were suggesting Amazon were in crisis, having over expanded too quickly, however, last month vice president, Stefano Perego, said their footprint in Europe will need to increase. If ignoring the headlines and focussing on their recent share price (which has increased by 40% since December) it would appear many still believe the future growth prospects for the logistics sector and the e-commerce giant remain positive.

In today’s UK market, prime yields for high-quality logistics assets leased at market rents, are valued at 5.0% which reflects a 25% discount from peak valuation (Q4 2021: 3.75%). Along with other real estate sectors, logistics values have fallen rapidly as interest rates increased sharply in the second half of 2022, the size of the adjustment dependent on location and quality of the underlying asset. These are breathtaking numbers for a sector seeing strong demand and clear evidence of continued income growth.

At Roebuck, we still believe logistics is the most attractive and dynamic sector in commercial property, especially given the major long‑term structural trends driving occupational and investor demand for logistics assets across the whole supply chain.

“In today’s UK market, prime yields for high-quality logistics assets leased at market rents, are valued at 5.0% which reflects a 25% discount from peak valuation (Q4 2021: 3.75%). “

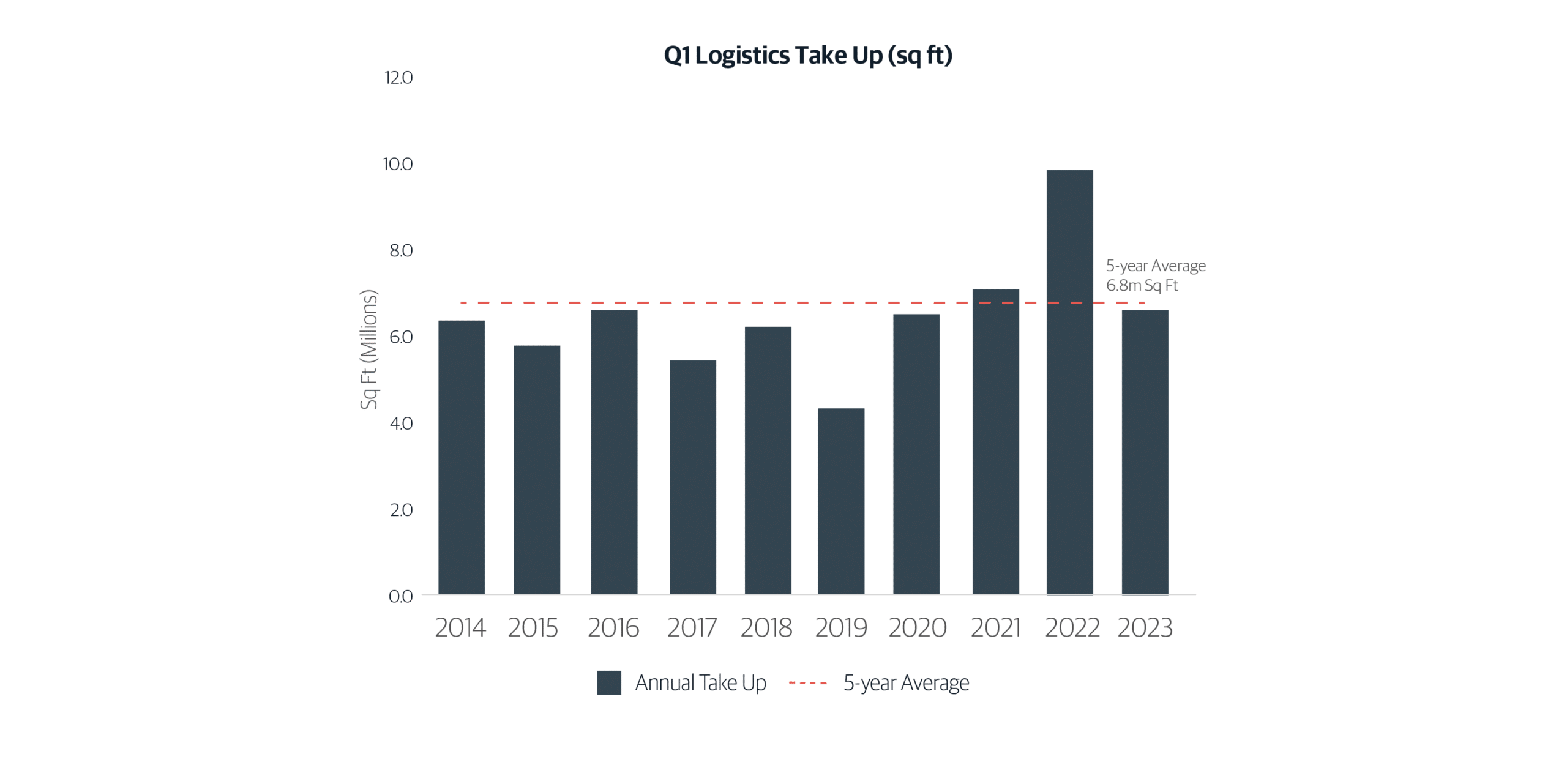

Whilst economic and capital market uncertainty has led to a significant reduction in investment volumes over the last nine months there are increasing signs of stabilisation in pricing. There also remains strong levels of occupational interest within the UK market (take up Q1 2023 – 6.6m sq ft vs 6.8m sq ft 5 year average) and headline rents increased across all UK regions by 2%-3% for the same period.

Roebuck are the only UK occupier focussed logistics investment manager with the unique advantage of being the retained advisor to the Culina Group (UK’s largest privately owned 3PL who operate from 22m sq ft across 100 sites) which provides an unparalleled insight into the operational element of the logistics sector. As we enter a new investment cycle, investors aiming to achieve superior risk adjusted returns need to focus on assets where the in place income can be significantly grown over the hold period.

To achieve this investors need to source opportunities and have the ability to accurately identify income enhancement potential – predominantly derived through a strong understanding of the customer operation and of the occupational markets. At Roebuck, our investment decisions are governed by our H.A.L.O principles to drive performance and ensure we have considered the risks and how they can be mitigated for each opportunity. The H.A.L.O principles we take into account pre acquisition are:

| Height | Difference between 3mts in height can result in 8% variance in pallet storage capacity |

| Asset (Specification) | Target flexible specifications that are best suited to meet demand from multiple tenant profiles |

| Location | Focus on supply constrained micro locations or infrastructure reliant locations |

| Operation (Performance) | Evaluate the true profitability of a site and operation pre acquisition which is derived through enhanced spec and is not reflected in valuation methodology |

Where are we focusing our investment activity?

In the current climate our main areas of focus for investing in the UK logistics sector are Big Box warehousing and Industrial Open Storage (IOS) sites.

Big Box

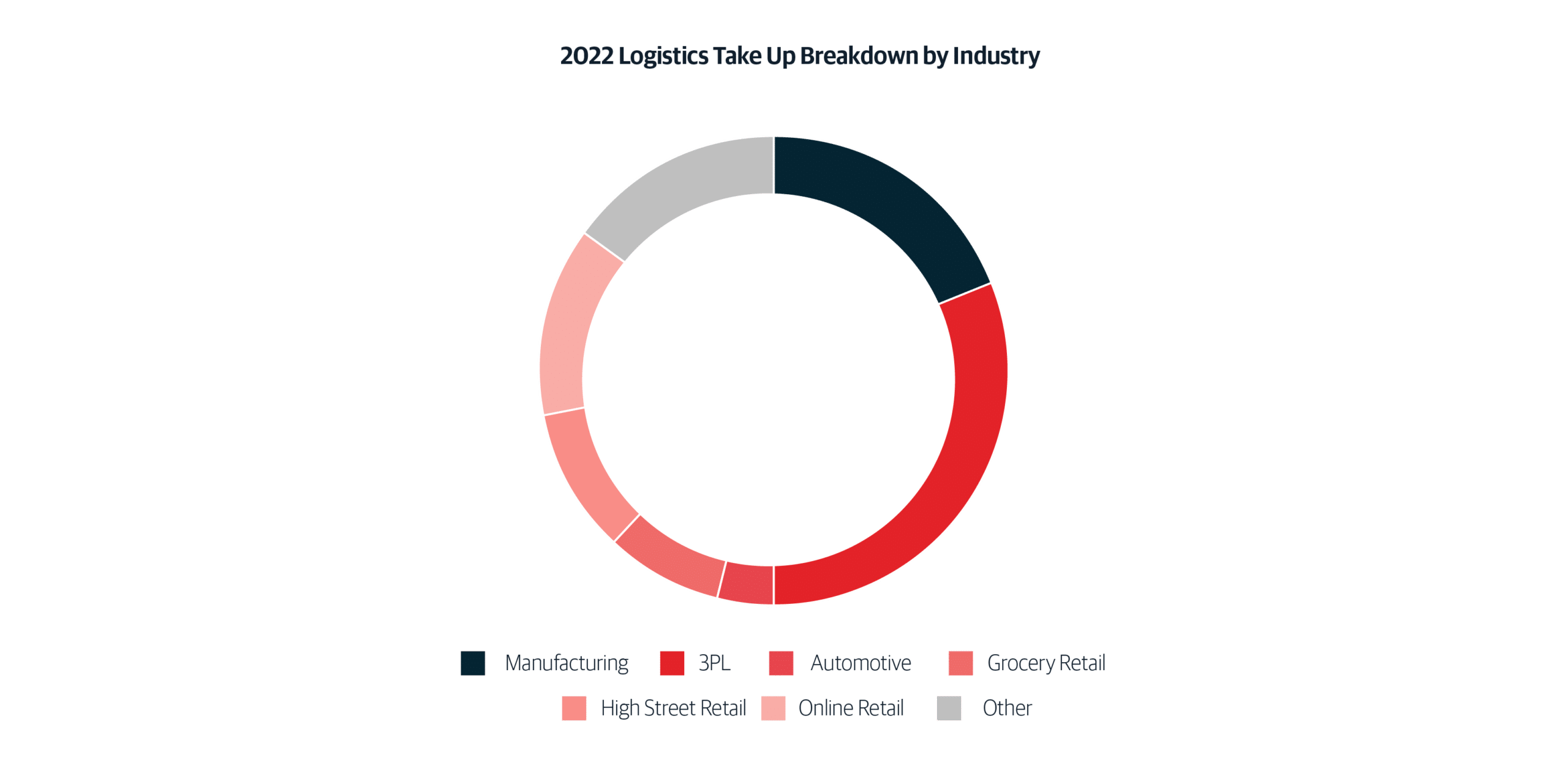

Over the last five years, we have acquired and sold over £1bn UK big box logistics assets, and completed c.17m sq ft of new leases, so it is a segment of the market we feel knowledgeable about but importantly we remain extremely positive. As the sector continues to significantly develop and transform, large format distribution centres (Big Box) are more and more in demand from a variety of end users particularly 3PL’s and ecommerce related occupiers.

Ecommerce remains an incremental demand driver for the long term, despite a slowdown in recent growth the trajectory for further increase of share of total retail sales is still hugely positive. Companies are having to invest in new and larger buildings that have the technical and ESG attributes required for modern operations. These buildings are often highly automated, act as a hub for distribution to end-consumer or last mile facilities, with occupiers usually investing a significant amount into the building creating further stickiness to reduce the chances of the tenant vacating before or at lease expiry. Furthermore, larger distribution centres significantly enhance the supply chain through increasing of inventory onshore, efficiency and productivity, which all play a vital role to ensure goods reach their end destination on time.

“As the sector continues to significantly develop and transform, large format distribution centres (Big Box) are more and more in demand from a variety of end users particularly 3PL’s and ecommerce related occupiers. “

Occupiers are increasingly choosing to consolidate older and smaller units into larger distribution centres, which offer economies of scale and the ability to optimise staffing and stock levels. We know first-hand from working with Culina, the medium-term ambitions for many logistics occupiers is to reduce the number of operational sites by consolidating out of smaller units into larger format warehouses to optimise their operational efficiencies.

Over the last decade, modern Big Boxes have developed into an institutional grade investment, however, given the large investment value for an individual asset is typically £50m or higher, in the current climate this is leading to a thinner pool of buyers. This is creating an opportunity to acquire high-quality asset’s at a larger discounts vs smaller formats much closer to replacement cost.

Industrial Open Storage (IOS) strategy

Open storage sites or ‘first mile’ assets are those forming a critical part of logistics supply chains and are typically characterised by a large land component, low site coverage and occupy infill locations with proximity to key highway, marine port and airport infrastructure.

Over the last twelve months there has been a significant amount of noise around IOS sites with a number of new entrants looking to raise capital and deploy into the sector. First things first, IOS is not a new concept, and companies have been storing product externally on yards and large format compounds for as long as they have been storing them in warehouses. At Roebuck we have invested and been focussed on open storage assets since 2010 and to date have managed and leased over 45m sq ft (over 1,000 football pitches) to end users across automotive, logistics, construction, retail, energy and medical industries.

So why sudden the surge of interest in IOS? The sector growth is supported by the same tailwinds (ecommerce expansion and supply chain optimisation) as ‘standard’ logistics but at 150-250 bps pricing spread which is providing attractive income return for investors, especially attractive in the current high interest rate environment. The spread in pricing reflects the current non-institutional grade of product (asset quality and tenancy structure), and the ownership landscape is highly fragmented and predominantly owner occupied. However, this segment of the market is emerging as a distinct and maturing asset class within the logistics sector given growing demand from both investors and end users for IOS product.

Unlike other Managers and Platforms looking to enter the space with a new IOS strategy, Roebuck holds a unique operational advantage through our relationship with key end users particularly derived from the Culina and Eddie Stobart transport activities (use types include truck terminals, rail integrated container storage, bulk and plant equipment storage).

“The Industrial Open Storage (IOS) sector is set to significantly explode over the next few years which will create further opportunities to invest in the sector.”

Utilising this operational insight and access to end user industries within the IOS subsectors, we target assets where the capital and rental values can be enhanced through scale, leasing, planning and capex driven upgrades to turn around sites for institutional grade product.

We have secured a pipeline over £100m of assets across multiple IOS sites, and the majority of the income is with tenants we have worked with for a long period of time, and have extensive knowledge of their businesses. These businesses have expansion needs which will also allow Roebuck and our investors to identify new sites and grow our IOS platform. If UK and Europe is to follow the US, which history will dictate we will, the IOS sector is set to significantly explode over the next few years which will create further opportunities to invest in the sector.

Final takeaway

Whilst James Dimon predicts more pain to come with real estate values, this brush should not be applied to all sectors in the real estate market. The future outlook for an office sky scraper in a secondary location is not the same as a state of the art logistics centre with significant reach to the majority of the country’s population. Our house view is the long-term secular trends are extremely compelling for investing in Big Box warehouses and IOS sites, and as long as we apply our disciplined H.A.L.O approach we strongly believe we will continue to deliver value for our investors across both segments of the UK logistics market.

Roebuck Asset Management is an institutional grade Pan European real estate logistics investor. They use their unique occupier insight and on the ground intelligence to unlock and realise value for their partners. Roebuck, which was founded in 2009 by Hugh Macdonald-Brown and Nick Rhodes, has managed assets across the UK and Europe with a cumulative Assets Under Management of £2.8 billion covering 30 million sq ft of floor area. Roebuck Asset Management is an affiliate of GFH Partners. To learn more about GFH Partners, visit their website.

None of the commentary above is to be construed as a solicitation, recommendation or offer to buy or sell any security, financial product, or instrument. Each of the statements, disclosures and disclaimers contained herein, including that these materials herein (A) are for informational purposes only, (B) are not an offer or solicitation to buy or sell any securities, and (C) should not be relied upon to make any investment decisions.

The content on our site is provided for general information only. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date.