Group Highlights:

- 40% growth in total income and enhanced profitability for 2024 supported by enhanced contributions across the Group’s subsidiaries, associates, and investments.

- Successful raise of U$S500 million of five-year sukuk during the fourth quarter.

- Recommended total cash dividend of 6.2% on par value (USD 0.0164 per share excluding treasury shares) for 2024, subject to approval by the General Assembly and regulators.

- Successful acquisition of AI Infrastructure in the US and income-yielding investments in student housing in US and the logistics warehousing sector in Saudi Arabia.

- Sale of Raffles Hotel and Beachfront Developments in Bahrain with a net gain of more than 20%.

GFH Financial Group B.S.C (“GFH” or “the Group”) (Bahrain Bourse: GFH) today announced its financial results for the fourth quarter (“the quarter”) and twelve months ended 31 December 2024 (“the year”).

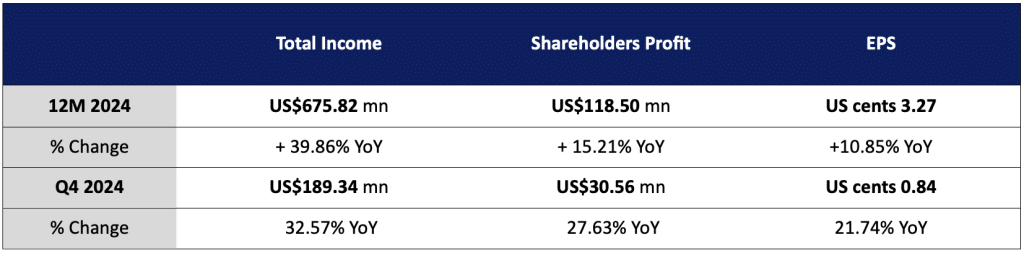

Net profit attributable to shareholders was US$30.56 million for the fourth quarter of the year versus US$23.94 million in the fourth quarter of 2023, an increase of 27.63%. This was attributed to higher contribution from the investment banking and proprietary investment business lines. Earnings per share for the quarter were US cents 0.84 compared with US cents 0.69 in the fourth quarter of 2023. Total income was US$189.34 million for the fourth quarter of the year, reflecting a 32.57% increase from US$142.82 million in the fourth quarter of 2023, supported by investment banking activities, proprietary income, and treasury operations. Consolidated net profit for the fourth quarter was US$32.96 million compared with US$24.18 million in the fourth quarter of 2023, a growth of 36.31%, despite fair value movements in the Group’s treasury and investment portfolio. Total expenses for the quarter were US$111.10 million, compared with US$84.06 million in the prior-year period, reflecting a 32.17% increase, largely due to business operation expansion.

The Group reported net profit attributable to shareholders of US$118.50 million for the full year compared with US$102.86 million in 2023, an increase of 15.21%. The gain is attributed to the Group’s strong investment banking performance, higher proprietary income, contributions from its commercial banking subsidiary, and a robust performance in treasury and asset management. Earnings per share for the year were US cents 3.27 compared to US cents 2.95 for the full year 2023, reflecting an increase of 10.85%. Total income for the year was US$675.82 million, up 39.86% from US$483.22 million for the previous year, demonstrating strong growth across all business lines. Consolidated net profit for the year was US$128.51 million, compared with US$105.23 million in 2023, an increase of 22.12%. Total expenses for the year were US$344.99 million, compared with US$264.30 million in 2023, reflecting a 30.53% increase.

Total equity attributable to shareholders was US$980.94 million at 31 December 2024, compared with US$989.54 million at year-end 2023, a decrease of 0.87%. Total assets of the Group were US$11.03 billion at 31 December 2024, compared with US$11.12 billion at 31 December 2023, down 0.81%.

In line with the Group’s results, the Board of Directors has recommended a total cash dividend of 6.2% on par value (US$0.0164 per share excluding treasury shares), subject to approval by the General Assembly and regulators.

Currently, GFH manages close to US$22 billion of assets and funds including a global portfolio of investments in logistics, healthcare, education and technology in the MENA region, Europe and North America.

Chairman

“GFH has once again continued to deliver sustainable value for its shareholders with sound financial results for the fourth quarter and full year 2024. Net profit attributable to shareholders grew by more than 15% for the year, reflecting our disciplined execution, diversification, and the strength of our core businesses. As a result, we are pleased to announce another solid dividend for our shareholders reflecting the Group’s ongoing commitment and ability to deliver shareholder value.

We are also proud to have successfully priced our U$S500 million five-year sukuk during the fourth quarter with demand from international investors. The solid double-digit growth in income and profitability highlights our ability to navigate market dynamics while seizing new opportunities.

Moving forward, we will continue to focus on building long-term resilience and delivering strong returns for our shareholders as we expand our global footprint and reinforce our position as a regional financial leader.”

CEO and Board Member

“We are pleased to report another year of positive performance, with total income surging by 40% to US$675.82 million, reflecting the success of our strategic initiatives and the expansion of our investment and treasury activities. Our net profit attributable to shareholders also rose by 15.2% to US$118.50 million, driven by the performance of our investment banking, treasury and proprietary investment activities, and commercial banking businesses.

Investment banking remained a key driver of profitability, supported by asset management growth and new deal-related income reinforcing our leadership in the sector. Our treasury and proprietary investments also delivered robust contributions, benefiting from well-executed capital deployment strategies and income from structured placements. Additionally, our commercial banking business continued its upward trajectory, supporting growth through disciplined restructuring and enhanced efficiency.

As we look ahead, we will continue to build on this momentum by capitalizing on new investment opportunities, growing our global asset base, and further capitalising on opportunities for growth in our core regional markets with an emphasis on Saudi Arabia and the UAE. This is in addition to strengthening our existing access to the US as a mature market, allowing us to continue to offer compelling asset management and investment products. Our focus remains on delivering sustainable returns, enhancing our financial strength, and driving value creation for all stakeholders. With a healthy balance sheet and a well-diversified platform, GFH is well-positioned to accelerate its growth and reinforce its status as a market leader in the region and beyond.”

Business Unit Highlights

GFH operates three main business lines that each continued to deliver sound performance and contributions during the fourth quarter, and which supported growth in the Group’s top and bottom line for the full year 2024.

Investment Management:

- During the fourth quarter, the Group reported investment banking deal income of US$13.95 million.

- A number of strategic investments and partnerships were also announced in Q4:

- GFH Partners successfully concluded three transactions:

- Secured A-Class purpose-built student housing assets worth US$300 million in the United States, bringing its US student housing platform to more than 5,500 beds and assets under management worth approximately US$900 million.

- Launched the US$96 million US AI Infrastructure Fund building on opportunities in the rapidly growing digital real estate sector, focusing on AI-driven data centers and data mobility platforms. The Fund is strategically investing in five leading platforms—Vantage Data Centers, DataBank, Switch, Vertical Bridge, and Novva—through two reputable partners, ensuring exposure to scalable, high-demand infrastructure.

- Launched the £44 million UK Food Logistics Fund investing in a mission-critical, income-generating food processing and cold storage facility in the UK. The Fund involves acquiring a 780,000-square-foot regional distribution center in Bridgwater, fully leased to Morrisons, the UK’s 5th largest grocer, serving 92 regional stores across the Southwest and Wales.

- Signing of a head of Terms with Gulf Warehousing Company (GWC), one of the GCC’s top logistics providers, whereby GFH will power GWC’s expansion plans by developing 200,000 square meters of Grade ‘A’ logistics facilities across key locations in Saudi Arabia.

- Strategic partnership announced with Panattoni Saudi Arabia for the development of 500,000 square meters of state-of-the-art logistics facilities in the Kingdom of Saudi Arabia. The collaboration focuses on creating high-quality logistics and industrial infrastructure across key cities, including Riyadh, Jeddah, and Dammam with a total planned investment of SAR 2 billion (US$500 million) over the coming five years.

- Investment in Invenergy, the largest privately held developer, owner, and operator of clean energy solutions, through investment vehicles managed by Blackstone’s infrastructure group.

Treasury & Proprietary Investments:

- The treasury business performed in line with the previous year, except for the fair value movement in the Treasury portfolio, which was positive in the previous year.

- Successful sale of a number of the Group’s proprietary investments including a stake in Raffles Al Areen Bahrain Palace for US$33 million and shares in Amwaj for US$40 million.

- Signing with Kempinski, in partnership with Infracorp, to launch Harbour Heights Kempinski Hotel and exclusive branded residences. The project will deliver the next level of luxury, waterfront living in the heart of Manama’s exclusive Bahrain Harbour.

- Launch of OUTLIVE, an innovative real estate venture rooted in health and well-being in MENA and Europe, to create masterplan communities and environments where personal health and social connections flourish, blending individual wellbeing with shared community life.

Commercial Banking:

- The Group’s commercial banking business, Khaleeji Bank (Khaleeji) achieved a net profit of US$27.86 million attributable to the Bank’s shareholders for the fiscal year ended 31st December 2024, compared to a net profit of US$ 23.88 million in 2023, an increase of 16.67%.

- Khaleeji’s launch of the “Hafeez” platform, an innovative digital banking platform designed to meet the needs of companies, which was updated by adding new services that facilitate procedures and enhance efficiency.

ESG Highlights

During the fourth quarter, the Group continued to further strengthen its Environmental, Social and Governance (ESG) related practices and expand its contributions to positive impact. Key initiatives during the fourth quarter included:

- Student Internship Programme with Britus International School: GFH successfully concluded its Student Internship Programme in collaboration with Britus International School. This initiative provided students with hands-on exposure to the financial sector, equipping them with valuable knowledge and practical skills to support their future careers.

- The Commitment to Cultural Preservation and Environmentally Sustainable Projects: During the fourth quarter a partnership was announced with authorities in Bahrain to support the restoration of one of Bahrain’s historic sites. Such collaborations contribute to the safeguarding of the Kingdom’s rich heritage for future generations.

- MoU with Safa, Bahrain’s Voluntary Carbon Offsetting Platform: The Group signed a Memorandum of Understanding (MoU) with Safa, Bahrain’s voluntary carbon offsetting platform, to advance climate action and sustainability initiatives in the Kingdom.

The Group’s financial results in full can be found at https://www.bahrainbourse.com/. Shares of GFH are traded under the ticker “GFH” on the Abu Dhabi Securities Exchange, Bahrain Bourse, Boursa Kuwait and Dubai Financial Market.

-ENDS-

About GFH Financial Group B.S.C.

GFH Financial Group is one of the most recognised financial groups in the Gulf region. Its businesses include Investment Management, Commercial Banking and Treasury & Proprietary Investments, with assets and funds under management exceeding US$21 billion dollars. The Group’s operations are principally focused across the GCC, North Africa and India, along with strategic investment in the U.S., Europe and the U.K. GFH is listed in Bahrain Bourse, Abu Dhabi Securities Exchange, Boursa Kuwait and Dubai Financial Market. For more information, please visit www.gfh.com..

Media Contacts:

GFH Financial Group

Nawal Al-Naji

Senior Manager- Corporate Communications

Tel: +973 17538538

Email: nalnaji@gfh.com

Website: www.gfh.com

[thrive_leads id=’103443′]