Manama, Bahrain – 10 August 2023:

Group Highlights for Q2 and H1 2023:

- Successfully executed its strategy and reported enhanced financial performance and results for the second quarter (Q2 2023) and first six months of the year ended 30 June 2023 (H1 2023).

- Delivered double-digit growth in income and profitability for Q2 and H1 2023 attributable to ongoing progress and contributions from the Group’s core business lines – Investment Management, Commercial Banking and Treasury & Proprietary Investments.

- Generated US$39.17 million in income from investment activities during Q2 2023 from the placement of the Group’s Healian regional healthcare platform as well as from the Group’s GCC Logistics Fund and US Opportunistic Fund.

- Strong contributions were made from investment banking activities including from GFH Capital, GFH Partners and GFH’s Private Equity transactions.

- MTM gains on the Group’s Treasury portfolio during Q2 2023 despite market volatility and additional positive contributions from other subsidiaries and associates.

- Affirmed ratings from Fitch of GFH’s Long- and Short-Term Issuer Default Ratings (IDR) at ‘B’ with Stable outlook. Key ratings drivers included GFH’s reduced exposure to illiquid unlisted investments, growth in treasury activities, increased fee-generative business from investment management and reduced legacy illiquid real estate investments.

- Launch of GFH Partners, a fully-owned subsidiary focused on expanding the Group’s global asset management capabilities with a particular focus on the real estate sector, where the Group currently manages over US$6 billion of assets.

GFH Financial Group B.S.C (“GFH” or “the Group”) (Bahrain Bourse: GFH) today announced its financial results for the second quarter (“the quarter”) and first six months of the year ended 30 June 2023 (“the period”).

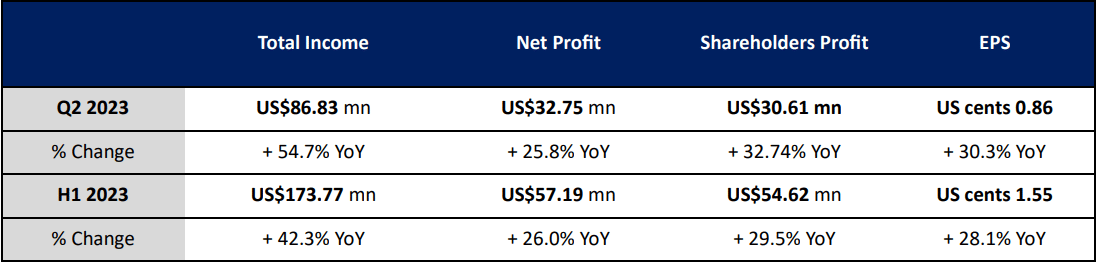

The Group reported net profit attributable to shareholders of US$30.61 million for the second quarter of the year up 32.74.% compared with US$23.06 million for the second quarter of 2022 reflecting continued steady growth and progress. Major contributions included income generated from the placement of the Group’s global and regional investments, commercial banking business and treasury activities. Earnings per share for the second quarter was US cents 0.86 compared to US cents 0.66 for the comparative quarter of 2022. Total income for the second quarter of 2023 was US$86.83 million compared to US$56.11 million for the second quarter of 2022, a rise of 54.7%. Consolidated net profit for the second quarter was US$32.75 million compared with US$26.03 million in the second quarter of 2022, an increase of 25.8%. Total expenses for the second quarter were US$54.08 million compared to US$30.08 million in the comparative quarter of 2022, an increase of 79.76%.

Net profit attributable to shareholders increased by 29.5% to US$54.62 million for the first half of 2023 compared with US$42.38 million in the first six months of 2022 in line with growth in contributions from all business lines. Earnings per share for the period was US cents 1.55 compared to US cents 1.21 for the first six months of 2022. Total income for the first half of 2023 was US$173.77 million versus US$122.13 million for the 2022 period, an increase of 42.3%. Consolidated net profit for the six-month period increased by 26.0% to US$57.19 million compared with US$45.38 million in the first six months of 2022. Total expenses for the period were US$116.58 million up 51.88% from US$76.76 million for the first six months of 2022.

Total equity attributable to shareholders was US$973.58 million at 30 June 2023 down 2.3% from US$996.60 million at 31 December 2022. The decrease was the result of dividends paid for the previous year along with fair value changes and changes in treasury shares. Total assets of the Group increased by 5.9% reaching US$10.34 billion at 30 June 2023 compared with US$9.76 billion at 31 December 2022.

The Group’s financial results in full can be found at https://www.bahrainbourse.com/. Shares of GFH are traded under the ticker “GFH” on the Abu Dhabi Securities Exchange, Bahrain Bourse, Boursa Kuwait and Dubai Financial Market.

Chairman, GFH Financial Group

“We’re pleased to report another quarter of solid growth in income and profitability and good results for the first half of 2023 with continued stable growth across the Group’s three business lines. The Group’s results and resilience are supported by a sharp thematic focus and concentration in attractive and defensive sectors and markets, where we will continue to build our presence. We’re also proud of the growing market confidence in GFH, our strategy and our progress, as recognised by Fitch during the second quarter, with the ratings agency reaffirming the Group’s ratings and stable outlook. Building on our positive momentum, we will continue to make strides across the business with the aim of further diversifying our operations, growing our revenues and building our portfolio of income-generating assets in key markets and across our core focus areas. As we do so, we remain committed to further strengthening our performance and returns for our shareholders.”

CEO and Board Member, GFH Financial Group

“The second quarter of the year saw GFH’s investments continue to deliver enhanced returns and value for the Group, our shareholders and investors. We are pleased with the strong growth in both income generation and profitability as we execute our strategy and take decisive steps towards further growth across our key business lines – investment management, commercial banking and treasury and proprietary investments. During the quarter, we were successful in placing more than US$328.4 million of investments relating to our regional healthcare platform Healian and other funds we have launched, which build on our experience in the healthcare and logistics sectors as well as in the US markets. Despite market volatility, our treasury activities also performed well during the quarter and contributed to our results, as did our commercial banking subsidiary Khaleeji Bank. We aim to build on these core areas and are particularly focused at present on accelerating the expansion of the Group’s MEA and GCC-based regional investment platforms. This includes those in high-growth, defensive sectors such as healthcare and life sciences, education and logistics – which will allow us to capitalise on long-term structural growth tailwinds in the region and our strong track record and expertise gained through decades of investing in global markets. I am confident that GFH is well-positioned to continue its success throughout the remainder of the year and beyond. We have a strong team in place, a clear strategy and a focus on delivering value to our stakeholders.”

Business Unit Highlights

GFH operates three main business lines that each continue to deliver positive performance and strong contributions, and have supported growth in the Group’s top and bottom line during the second quarter and half-year 2023.

Investment Management:

- GFH’s flagship regional healthcare platform, Healian, continued to go from strength to strength, successfully closing US$250 million of investors’ capital commitments for immediate deployment during H2 2023. This is a landmark achievement driven by robust sector and platform fundamentals, as well as the resilience of the GCC countries. Healian has a buy-and-build strategy targeting leading healthcare providers in underpenetrated regional gateway cities and highly specialized therapeutical areas such as cardiology, neurology, fertility, and endocrinology. Healian has signed a number of deals, most recently in Saudi Arabia, and has a robust and actionable pipeline of opportunities at various stages of the acquisition process. GFH anticipates a potential listing of the platform on the more liquid regional exchanges in the forthcoming years.

- Income of US$25.97 million was generated from the Group’s GCC Logistics Fund and US Opportunistic Fund. The GCC Logistics Fund was launched following the Group’s highly successful European and US investments in the logistics sector with the aim of capitalizing on the strong economic performance of the Saudi and UAE markets, while the US Opportunistic Funds allow the Group to capture opportunities in the US where it has deep market experience and specialist subsidiary asset managers on the ground.

- The second quarter marked the launch of GFH Partners, a fully-owned subsidiary focused on expanding the Group’s global asset management capabilities with a particular focus on the real estate sector, where the Group currently manages over US$6 billion of assets. Headquartered in the Dubai International Financial Centre (DIFC) with a global remit, GFH Partners manages assets in the stabilized and core markets of the US, the UK and the GCC, where it aims to capture and capitalize on strong economic growth prospects in these regions.

- GFH’s education investment arm, Britus Education, announced its partnership with FraklinCovey Middle East Education to tailor a three-year development programme for Britus students and educators. The programme includes a comprehensive K-12 school improvement model.

Commercial Banking:

- During the first half of 2023, the Group’s commercial banking business, Khaleeji Bank (Khaleeji), reported continued progress and growth by recording a net profit of US$18.44 million. Khaleeji’s gross income contributed 23.7% of the total income of the Group. Income from Khaleeji witnessed a 11.9% growth during the current period compared to the corresponding period of 2022.

Treasury & Proprietary Investments:

- The Group’s positive performance in its treasury and proprietary investment activities was supported by a conservatively positioned fixed income portfolio and benefited from modest gains in modest positions, offsetting the higher funding costs driven by increased central bank rates.

- Looking ahead, GFH seeks opportunities to lock in higher yields for the investment portfolio and diversify its funding sources to support the Group’s growth.

ESG Highlights

During the quarter, GFH continued to implement positive initiatives furthering its commitment to Environmental, Social and Governance (ESG) related practices. Key among these were:

- Joined the Future Investment Initiative (FII) Institute as a Strategic Partner alongside the Institute’s list of world-class global partners. FII Institute is a leading nonprofit foundation with an investment arm and one agenda: “Impact on Humanity.” Its partners include major global and regional banking and financial players in addition to market leaders from across other industries. The partnership will see GFH and FII Institute engage in a range of strategic activities aimed at advancing projects and initiatives that help shape a better world across the Institute’s four key focus areas – Artificial Intelligence (AI) & Robotics, Sustainability, Healthcare, and Education.

- Inaugurated the 58 Avenue afforestation initiative in Bahrain, which saw the Group plant trees across a 2 km area in collaboration with the Capital Municipal Council and CleanUp Bahrain, another project in its considerable and ongoing efforts aimed at raising awareness of the critical need for environmental preservation and its contributions to agricultural development across the Kingdom.

- GFH’s internship programme gave students from international K12 schools the opportunity to gain hands-on experience in the financial industry. During the programme, students were provided with on-the-job training within multiple departments in the Group. The aim was to provide young individuals with exposure to the professional workplace to support them in pursuing their desired higher studies, and to help equip future generations with the necessary skills and experiences to succeed in their careers and contribute to national and regional development.

-ENDS-

About GFH Financial Group B.S.C.

GFH Financial Group is one of the most recognised financial groups in the Gulf region. Its businesses include Investment Management, Commercial Banking and Treasury & Proprietary Investments, with assets exceeding 18 billion US dollars. The Group’s operations are principally focused across the GCC, North Africa and India, along with strategic investment in the U.S., Europe and the U.K. GFH is listed in Bahrain Bourse, Abu Dhabi Securities Exchange, Boursa Kuwait and Dubai Financial Market. For more information, please visit www.gfh.com.

Media Contacts:

GFH Financial Group

Nawal Al-Naji

Senior Manager- Corporate Communications

Tel: +973 17538538

Email: nalnaji@gfh.com

Website: www.gfh.com

[thrive_leads id=’103443′]