Date: 20/03/2025

Name of Listed Company: GFH Financial Group B.S.C.

Day and Date of the Meeting: Thursday 20/03/2025

Start time of the Meeting: 09:30 pm Bahrain Time

End time of the Meeting: 11:00 pm Bahrain Time

Venue of the Meeting: GFH House, Bahrain Financial Harbour – Sea Front

Chair of the Meeting: Mr. Abdulmohsen Al Rashed

Quorum of the Total Attendance: 46.42%

Decisions and Resolutions of the Ordinary General Meeting:

The following items of the agenda have been approved:

- The minutes of the previous Annual General meeting held on 09th October 2024.

- The Board of Directors’ report on the Group’s business activities for the year ended 31 December 2024.

- The Sharia Supervisory Board’s report on the Group’s business activities for the year ended 31 December 2024.

- The external auditor’s report on the financial year ended 31 December 2024.

- The consolidated financial statements for the financial year ended 31 December 2024.

- The Board of Directors’ recommendation to allocate the net profit for the year 2024 as follows:

- To transfer an amount of US$ 11,850,400 to the statutory reserve.

- To allocate an amount of US$ 1,500,000 to Zakat Fund.

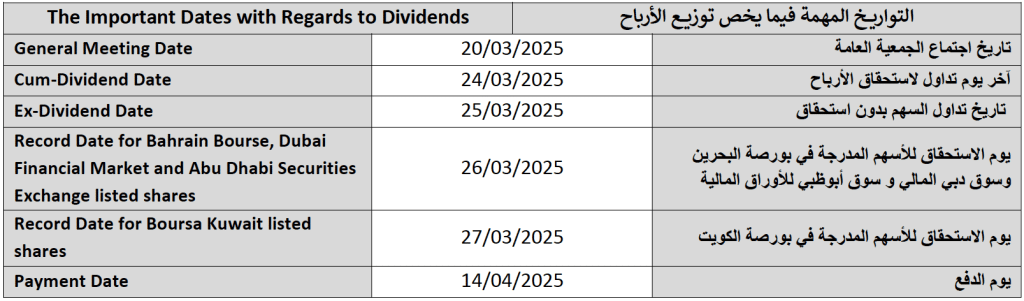

- To distribute cash dividends of 6.2% of the nominal value of all the ordinary shares, net of treasury shares, up to US$ 61 million, equivalent to US$ 0.0164, BD 0.0062, UAE dirhams 0.0602 per share.

- To transfer the remaining amount of approximately US$ 44,153,600 as retained earnings for next year.

- The Board’s recommendation to allocate an amount of US$ 2.4 million as remuneration for members of the Board of Directors.

- The corporate governance report for the financial year ended 31 December 2024, including the Group’s compliance with all the governance requirements issued from the Ministry of Industry, Commerce and Tourism and the Central Bank of Bahrain.

- Transactions concluded during the ended year with any related parties or major shareholders of the Group, as indicated in Note 26 of the financial statements for the year 2024 and the Board of Directors’ Report, pursuant to the provisions of Article (189) of Bahrain’s Commercial Companies Law.

- Approve to buy back group shares (treasury shares) not exceeding 10% of the total shares issued for the following purposes, subject to obtaining the CBB’s approval:

- Attracting strategic shareholders in line with the criteria and benefits as set by the group for this category, and subject to Central Bank of Bahrain’s approval on every sale transaction.

- Support the share price.

- Staff incentives.

- The reappointment of the external auditors of the Group for the year ended 31 December 2025 and authorize the Board of Directors to set their fees.

- Release the Board of Directors from liability in respect of their acts for the financial year ended 31 December 2024.

- Any recent issues in accordance with Article (207) of the Commercial Companies Law.

Decisions and Resolutions of the Extraordinary General Meeting:

- The minutes of the previous Extraordinary General meeting held on 3 April 2022.

- Approve the issuance of Tier 1 Financial Instruments and/or Sukuk (Additional Tier 1 Capital) with a total value not exceeding BD 200 million (Two Hundred Million Bahraini Dinars), through one or multiple issues, for the purposes of improving capital ratios to meet the Group’s financial and strategic requirements, and to authorize the Bank’s Board of Directors to take all the necessary formalities and decisions regarding the structure, profit rate, the value and currency of the issue, the associated costs, the term & conditions of the issue, approval of the subscription and its conditions, and any other conditions, subject to the approval of the Central Bank of Bahrain.

- Authorize the Chairman of the Board of Directors and / or the Chief Executive Officer of the Group and / or his sole authorized signatory, to initiate the necessary procedures for the implementation of item 2 above and to sign and submit any related documents.