In its early days, fintech was viewed with some skepticism with respect to its disruptive potential. Now, it is regarded as the positive driving force behind the banking and payments industry’s digital transformation. The result is a vibrant fintech ecosystem fueled by investors keen to capitalise on emerging and cutting-edge technologies at the vanguard of a digital future.

Globally, fintech funding rebounded by nearly 70% in 2021, hitting $210 billion, according to KPMG. Almost 5,700 deals were signed and funded by private equity and venture capital last year, driven by subsectors such as payments and blockchain. In the EMEA region, fintech investments reached $77.4 billion in 2021 as confidence grew following the pandemic.

Unsurprisingly, the ‘big six’ fintech firms, fared best during the pandemic, as investors favoured safer late-stages over seed- and early-stages. Today, however, startups demand the same or more spotlight. In fact, over the last two years, fintech startups worldwide have tripled to reach 26,000, BCG data indicates. The landscape is particularly buoyant in MENA, where startup funding doubled during Q1 with fintechs accounting for 41% of the total $864 million raised.

The growth is being driven by the UAE and Saudi Arabia, which represent the largest markets in the region and are home to most of the Middle East’s 500+ fintechs. Today, Saudi Arabia hosts more than 80 fintech startups and has, alongside the UAE, witnessed a flurry of major deals in recent months. In April last year, Saudi’s buy now, pay later (BNPL) startup Tamara raised $110 million, shortly followed by Tabby, a Dubai-based BNPL startup, raising $50 million. Some experts have predicted that the region’s BNPL market will grow ‘at least twice as fast’ as the global market, which is forecast to grow at around 30% annually over the next five years.

Fintech now engrained in banking sector

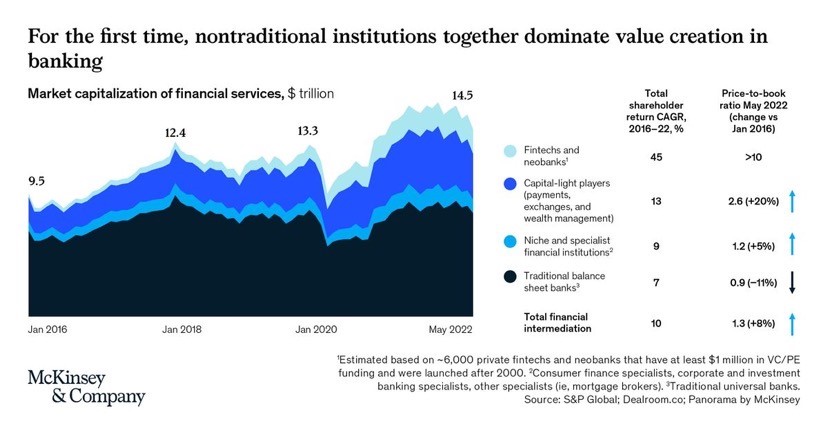

A report from Plaid claims fintech has now “reached mass adoption” with more people now using fintech applications than they do social media in certain geographies. Banks themselves are also being heavily disrupted by the fintech surge. McKinsey estimates that AI alone can generate up to $1 trillion additional value for the global banking industry annually.

From digital money transfers to AI-powered credit underwriting or investment advice, digital solutions will define how consumers interact with the banking sector over the next decades. In the lower middle market M&A space, there are examples of startups like Axial leveraging algorithms and data to match companies with potential acquirers. Processes across the value chain are becoming increasingly automated, freeing up employees to engage in higher-value activities like business development, deal structuring and negotiation.

One example of how banks and fintechs can leverage one other’s competitive advantages came in the US market recently where Cross River Bank engaged fintech company Affirm. In the partnership, Affirm helped Cross River to build an innovative BNPL solution. Meanwhile, Affirm tapped into Cross River’s expertise in regulatory compliance, lending and processing transactions. These kinds of win-win partnerships that enable product-led growth while minimising customer acquisition costs illustrate the benefits of collaboration and joint ventures in such a complex and transformative space.

“From digital money transfers to AI-powered credit underwriting or investment advice, digital solutions will define how consumers interact with the banking sector over the next decades.”

Over the coming years, the banking sector must continue to embrace fintech to increase agility and reduce costs in a remarkably challenging operating environment, embroiled by frequent regulatory shifts. As technology and computing power improve, the power of fintech will only grow. It will ultimately become an everyday part of life with embedded fintech like Apple Card slated to dominate the industry by 2030.

Such is the extent to which technology will empower banking, it is estimated that the broader fintech market will grow at a CAGR of almost 20% through to 2028. Clearly, there is significant value in investing in fintech, with huge potential for growth and cost optimisation.

Fintech is undoubtedly among the most promising sectors for investment but the challenge is in identifying and harnessing the right opportunities.

How can investors harness the potential of fintech?

Fintech is a dynamic and fast-evolving sector. Making the most of it requires an intelligent and informed approach, completeness of vision, and best-in-class execution led by deeply engaged and aligned founders and management teams.

Blockchain-driven payments and wealth management applications, for instance, are a high-growth area with experts predicting it will become the norm for people to manage all their finances on a single platform.

As part of our strategy, we seek out these promising sub-sectors, and target category-defining companies that are growing at scale, have attractive unit economics, clear path to profitability, and are set to increase in value thus maximising the returns for our investors. For example, in our recently closed tech portfolio, we backed market-leading payments and wealth management platforms that specialise in the kind of next-gen technologies that are set to disrupt the old economy.

Spotlight on Technology Investments

GFH differentiates itself in this space through its disciplined approach towards investing, proprietary deal sourcing which is often off-market and partnerships with leading global fintech-focused asset managers, as well as the Group’s track record and demonstrated ability to add value at each incremental step of the process from origination and portfolio management through to exit.

To conclude, the fintech sector will continue to benefit from long-term structural tailwinds over the coming decades, but navigating the twists and turns of this rapidly evolving space will require investors to be both agile and decisive. Investors must keep their finger on the pulse and seize opportunities when they arise.

Fast Facts

US$210bn

global fintech funding in 2021

US$77.4bn

EMEA fintech investments in 2021

41%

share of fintechs in startup funding in Q122

20%

estimated CAGR growth of fintech through 2028

Hammad Younas

Chief Investment Officer

Private Equity

The content on our site is provided for general information only. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. Although we make reasonable efforts to update the information on our site, we make no representations, warranties or guarantees, whether express or implied, that the content on our site is accurate, complete or up to date.