Group Highlights to Date

- Total Income increases by 24.2% for the third quarter and an increase of 42.9%% for the first nine months of 2024 compared to the previous year.

- Co-investment made alongside the largest PE player in the US, in a leading US-based independent renewable energy platform.

- Undertaking of an investment in a leading European maritime ship leasing platform alongside Hayfin Capital Management with a commitment of more than US$50 million,

- Acquisition of two industrial cold storage and distribution facilities located in Texas and Massachusetts with a value exceeding US$50 million.

- Acquisition of four A grade student housing assets, with a total number of beds exceeding 1,600 across Tennessee, Kentucky, Texas and Minnesota with a total value exceeding US$200 million.

- Achieved the oversubscription of the Group’s US$500 million Sukuk program by more than 4x and US$2 billion from regional and international investors.

- Participation in the Future Investment Initiative in Riyadh, KSA, and launch of the Group’s AI powered mobile App including real time onboarding and investment subscription.

- Concluded a partnership with Edamah to develop Bahrain Surf Park, the Middle East and North Africa region’s first surf park utilizing Wave garden’s state-of-the-art ‘Cove’ technology.

GFH Financial Group B.S.C (“GFH” or “the Group”) (Bahrain Bourse: GFH) today announced its financial results for the third quarter (“the quarter”) and first nine months of the year (“the period”) ended 30 September 2024.

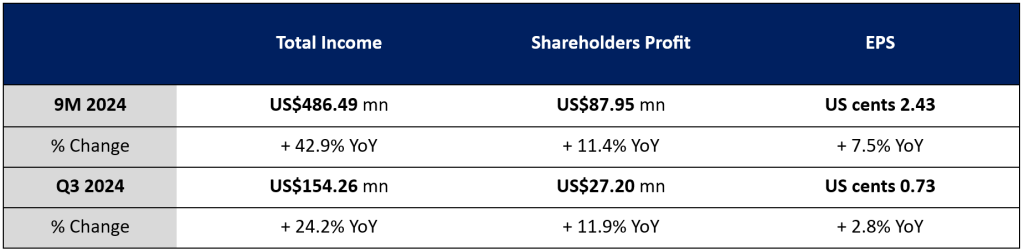

Net profit attributable to shareholders was US$27.20 million for the third quarter of the year, compared to US$24.31 million in the third quarter of 2023. The increase of 11.9% was driven by its investment management, commercial banking, and treasury and proprietary investment activities. Earnings per share for the third quarter was US cents 0.73, compared with US cents 0.71 in the third quarter of 2023, an increase of 2.8%. Total comprehensive income attributable to shareholders was US$ 46.59 million for the third quarter, compared with US$22.95 million in the third quarter of 2023, an increase of 103.0%. Total income for the quarter reached US$154.26 million, up 24.2% from US$124.19 million in Q3 2023. Consolidated net profit for the third quarter was US$27.659 million, compared to US$23.86 million in Q3 2023, an increase of 15.9%. Total expenses for the quarter were US$70.03 million, up from US$ 63.67 million in the prior-year period, an increase of 10.0%.

The Group reported a net profit attributable to shareholders of US$87.95 million for the first nine months of the year, compared with US$78.92 million in the 2023 period, an increase of 11.44%. The gain is attributed to contributions from the investment banking business, share of profits in the Group’s commercial banking subsidiary and income from treasury investment activities. Earnings per share for the nine-month period was US cents 2.43, compared with US cents 2.26 in the same period of 2023, an increase of 7.5%. Total comprehensive income attributable to shareholders was US$113.9 million for the first nine months of the year, compared with US$75.23 million in the 2023 period, an increase of 51.4%. Total income for the period was US$486.49 million, up 42.9% from US$340.40 million year-on-year. Consolidated net profit for the first nine months of the year was US$95.56 million, compared with US$81.05 million in the corresponding period of 2023, an increase of 17.9%. Total expenses for the nine-month period were US$233.90 million, compared with US$180.24 million in the same period of 2023, an increase of 29.8%.

Total equity attributable to shareholders was US$997.05 million as of 30 September 2024, versus US$989.54 million at 31 December 2023, a slight increase of 0.8%. Total assets of the Group were US$10.94 billion as of 30 September 2024, compared with US$11.12 billion at 31 December 2023, a marginal decrease of 1.6%. This was primarily due to net sale of proprietary investments.

Currently, GFH manages over US$21 billion of assets and funds including a global portfolio of investments in logistics, healthcare, education and technology in the MENA region, Europe and North America.

ESG Highlights

The Group continued to effectively execute on its Environmental, Social and Governance (ESG) strategy undertaking key initiatives in the third quarter including:

- Launched the Executive Associate Programme: The Group has designed and launched a programme to empower exceptional Bahraini graduates. This initiative is borne out of GFH’s commitment to nurturing future leaders by investing in top scholars to enhance their skills.

- Supporting the Supreme Council for Women: GFH has contributed funds for the upcoming Bahraini Women’s Day celebrations that take place annually in December at an official ceremony under the support of His Majesty the King.

- Sponsoring BREEF Endurance Races for 2024 & 2025 seasons: GFH continues its partnership with the Bahrain Royal Equestrian & Endurance Federation for its remaining 2024 and upcoming 2025 races, reflecting the Group’s support for world-renown sports.

The Group’s financial results in full can be found at https://www.bahrainbourse.com/. Shares of GFH are traded under the ticker “GFH” on the Abu Dhabi Securities Exchange, Bahrain Bourse, Boursa Kuwait and Dubai Financial Market.

-ENDS-

About GFH Financial Group B.S.C.

GFH Financial Group is one of the most recognised financial groups in the Gulf region. Its businesses include Investment Management, Commercial Banking and Treasury & Proprietary Investments, with assets and funds under management exceeding US$21 billion dollars. The Group’s operations are principally focused across the GCC, North Africa and India, along with strategic investment in the U.S., Europe and the U.K. GFH is listed in Bahrain Bourse, Abu Dhabi Securities Exchange, Boursa Kuwait and Dubai Financial Market. For more information, please visit www.gfh.com.

Media Contacts:

GFH Financial Group

Nawal Al-Naji

Senior Manager- Corporate Communications

Tel: +973 17538538

Email: nalnaji@gfh.com

Website: www.gfh.com

[thrive_leads id=’103443′]